The precious metals of Gold and Silver saw net weekly gains, +$12.30 (1.0%) to $1303.70, and +$0.09 (0.5%) to

$16.55 respectively. Near term outlook offers further upside. The m/t

outlook will only

turn decisively bullish with Gold >$1400 and Silver >$18s.

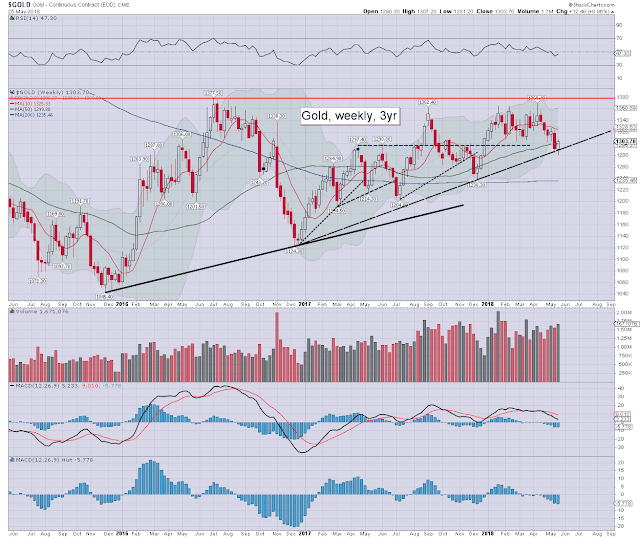

Gold weekly

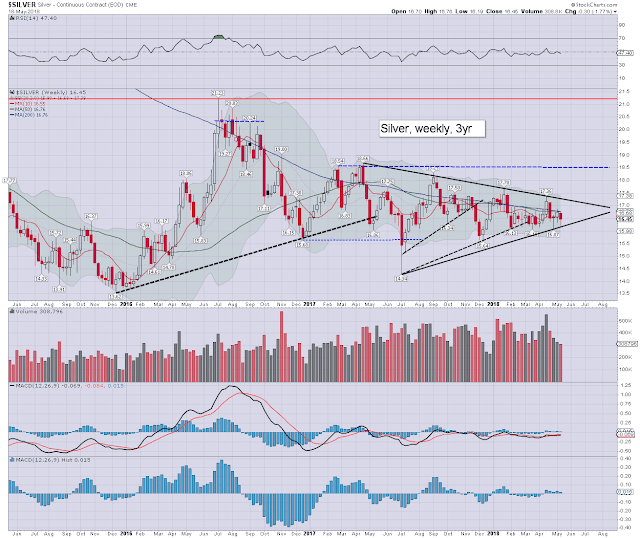

Silver weekly

Summary

Suffice to add, this weekly gain in gold was pretty important, and negates the s/t threat that the Dec'2017 low of $1238 might be tested. Instead, s/t outlook is bullish into early June. The next rate hike (June 13th) will be a reminder though that rates are still being regularly raised. Higher rates are inherently bearish for gold.

Things will only turn decisively bullish if Gold can break and hold the $1400 threshold. Arguably, Silver just needs the $18s.

Friday 25 May 2018

Friday 18 May 2018

Bearish metals

The precious metals of Gold and Silver saw net weekly declines, -$29.40 (2.2%) to $1291.30, and -$0.30 (1.8%) to

$16.45 respectively. Near term outlook is highly uncertain, and will be greatly dependent upon the USD and bond yields.

Gold weekly

Silver weekly

Summary

Suffice to add, gold remains stronger than silver, but both metals are lagging the broader commodity complex.

Ongoing s/t strength in the USD and higher bond yields is really keeping the downward pressure on gold, and to a slightly less degree... silver.

Technically, gold and silver both avoided a weekly close under key rising trend. The next few weeks are going to be rather important!

Gold weekly

Silver weekly

Summary

Suffice to add, gold remains stronger than silver, but both metals are lagging the broader commodity complex.

Ongoing s/t strength in the USD and higher bond yields is really keeping the downward pressure on gold, and to a slightly less degree... silver.

Technically, gold and silver both avoided a weekly close under key rising trend. The next few weeks are going to be rather important!

Friday 11 May 2018

Weekly gains

The precious metals of Gold and Silver saw net weekly gains, +$6.00 (0.5%) to $1320.70, and +$0.23 (1.4%) to

$16.75 respectively. Near term outlook offers further upside. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Gold remains broadly stronger than Silver, but both metals are m/t choppy since early 2017, especially relative to the broader commodity complex.

Partly based on m/t bullish trends in copper and oil, I'm still leaning toward an eventual bullish breakout in Gold. For now, there is ZERO sign of that.

Gold weekly

Silver weekly

Summary

Gold remains broadly stronger than Silver, but both metals are m/t choppy since early 2017, especially relative to the broader commodity complex.

Partly based on m/t bullish trends in copper and oil, I'm still leaning toward an eventual bullish breakout in Gold. For now, there is ZERO sign of that.

Subscribe to:

Posts (Atom)