Despite some distinct bullish hysteria in the gold bug community as at end January, February was another reminder of the broader trend. Gold and Silver saw net monthly declines of -$70.60 (-5.5%), and -$0.74 (-4.3%) respectively. New multi-year lows look due across the spring and summer.

Gold, monthly, fibs

Silver, monthly, fibs

Summary

So much for the January gains, almost fully negated by the net February declines.

March will offer a real opportunity at new multi-year lows... with Gold set to trade <$1130... opening the door to the giant $1000 threshold this summer.

Holding to all original downside targets... that stretch back over 3 years.

--

*as ever.. if the precious metals are weak... it does not bode well for the mining stocks... regardless of any main market strength.

Friday 27 February 2015

Friday 20 February 2015

Bearish end to a bearish week

Precious metals continue to see every minor bounce faded, with Gold and Silver seeing Friday declines of -0.5% and -1.0% respectively. Across the week, Gold and Silver fell by -2.2% and -6.0% respectively. New multi-year cycle lows look due into the spring.

GLD,weekly

SLV, weekly

Summary

Little to add.

The near term trend remains increasingly weak, and the bigger weekly/monthly cycles remain broadly bearish.

Gold is headed for the giant $1000 threshold.. with Silver in the 12/10 zone.

It remains viable by late summer, Gold 900/875..as a final capitulation level.

GLD,weekly

SLV, weekly

Summary

Little to add.

The near term trend remains increasingly weak, and the bigger weekly/monthly cycles remain broadly bearish.

Gold is headed for the giant $1000 threshold.. with Silver in the 12/10 zone.

It remains viable by late summer, Gold 900/875..as a final capitulation level.

Tuesday 17 February 2015

Rough start to the week

The precious metals have started another week on a particularly weak note. Gold and Silver opened sharply lower, settling -1.7% and -4.3% respectively. Near term outlook remains bearish... and new multi-year lows look due into the spring.

GLD, daily

SLV, daily

Summary

Little to add.

Whilst the Gold bug community continue to spout lies (not least about Armstrong), and enjoy living in their 'world of delusion'... the broader trend remains weak.

New cycle lows look due...

Primary Gold $1000, secondary $900/875 by late summer.

.. that will probably equate to Silver flooring somewhere in the 12/10 zone... as I've been saying for the last THREE years.

-

GLD, daily

SLV, daily

Summary

Little to add.

Whilst the Gold bug community continue to spout lies (not least about Armstrong), and enjoy living in their 'world of delusion'... the broader trend remains weak.

New cycle lows look due...

Primary Gold $1000, secondary $900/875 by late summer.

.. that will probably equate to Silver flooring somewhere in the 12/10 zone... as I've been saying for the last THREE years.

-

Friday 13 February 2015

Metals remain broadly bearish

Whilst the US capital markets grew in confidence across the week, the precious metals lost a little more of their appeal as a 'safety play'. Gold and Silver saw mixed net weekly changes of -0.5% and +3.2% respectively. Outlook remains broadly bearish into the mid/late summer.

GLD, weekly

SLV, weekly

Summary

Little to add.

A second consecutive weekly decline for Gold, although a notable gain for Silver. In general though, at the current rate, we'll see an important weekly bearish MACD cross in about two weeks.

-

Kooky chatter from silverfuturist

Always recommended viewing!

GLD, weekly

SLV, weekly

Summary

Little to add.

A second consecutive weekly decline for Gold, although a notable gain for Silver. In general though, at the current rate, we'll see an important weekly bearish MACD cross in about two weeks.

-

Kooky chatter from silverfuturist

Always recommended viewing!

Friday 6 February 2015

A major weekly decline

With US equity markets rebounding powerfully from an early Monday morning floor, the precious metals saw a week of broad weakness. Gold and Silver saw net weekly declines of -3.9% and -3.1% respectively. Near term outlook is very bearish, with new multi-year lows due this spring.

GLD, weekly

SLV, weekly

Summary

A new multi-week down cycle appears well underway.... with new lows due into the spring.. if not across the summer.

Holding to original targets of Gold $1000, if not the 900/875 zone by Sept/Oct.

GLD, weekly

SLV, weekly

Summary

A new multi-week down cycle appears well underway.... with new lows due into the spring.. if not across the summer.

Holding to original targets of Gold $1000, if not the 900/875 zone by Sept/Oct.

Monday 2 February 2015

Starting a new month on a downer

The precious metals have started the month with some rather notable weakness. Gold and Silver saw net daily declines of -0.8% and -0.4% respectively. There remains high possibility that a multi-week up cycle has recently maxed out... with new multi-year lows this spring.

GLD, daily

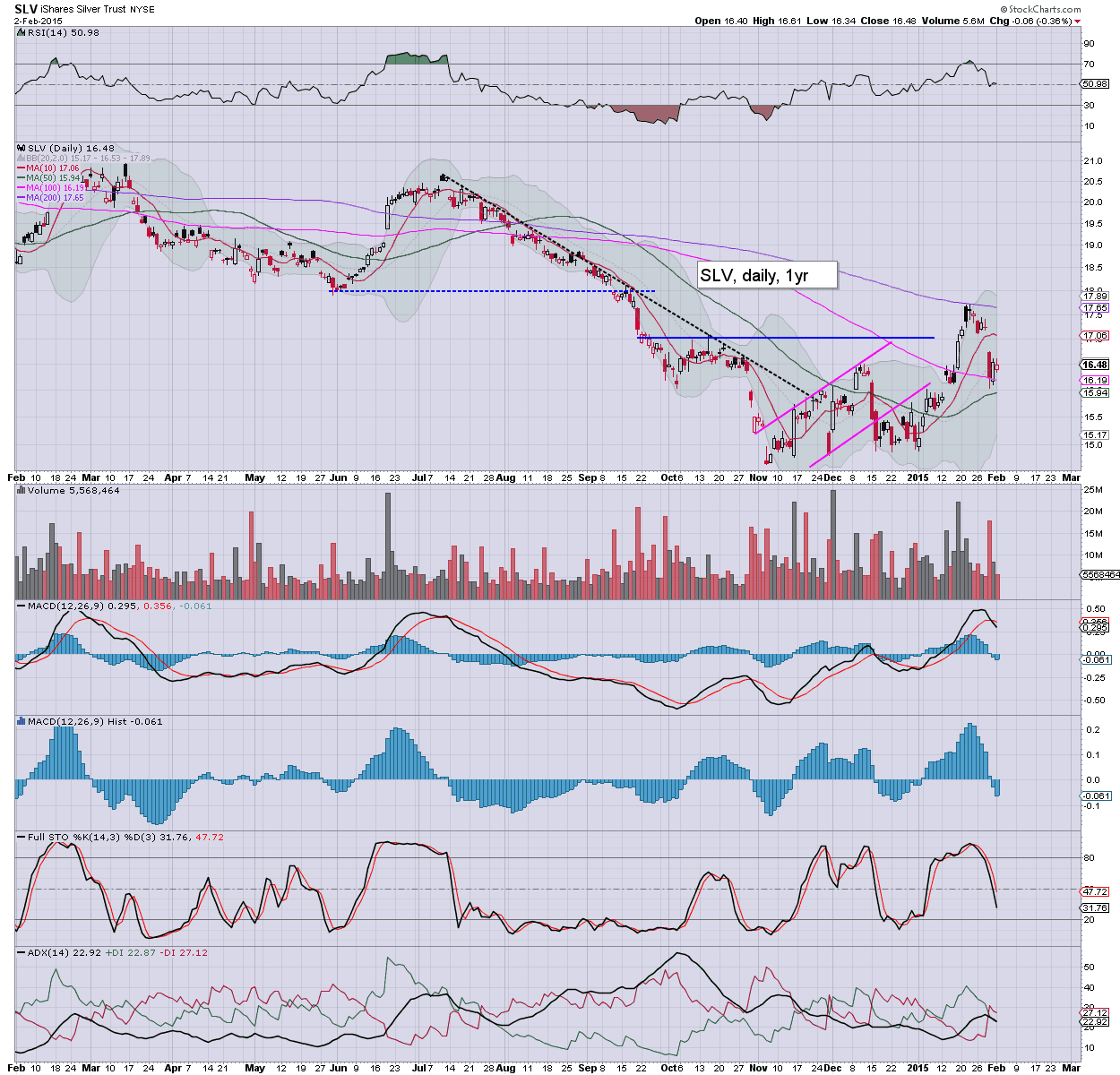

SLV, daily

Summary

Little to add.

Periodic rallies.... but never sustaining for long.... Gold still looks headed for the giant $1000 threshold.

GLD, daily

SLV, daily

Summary

Little to add.

Periodic rallies.... but never sustaining for long.... Gold still looks headed for the giant $1000 threshold.

Subscribe to:

Posts (Atom)