The precious metals of Gold and Silver saw net December changes of +$14.60 (0.7%) to $2071.80, and -$1.57 (6.1%) to $24.09 respectively. For the year, Gold and Silver saw net changes of +$245.60 (13.4%) and +$0.05 (0.2%) respectively.

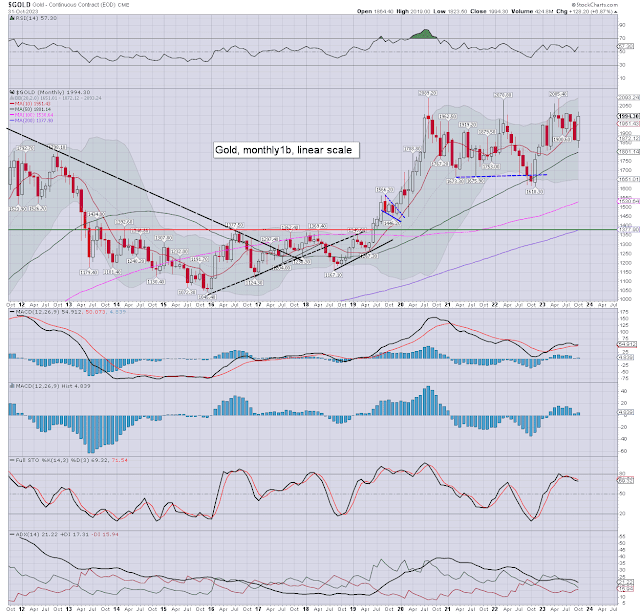

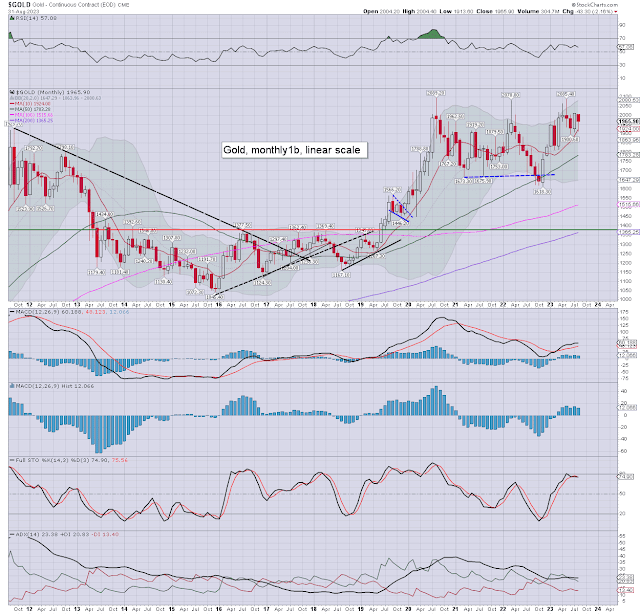

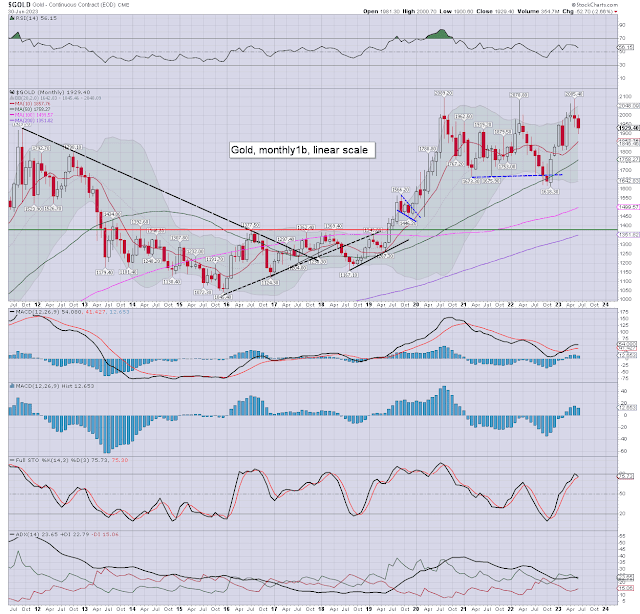

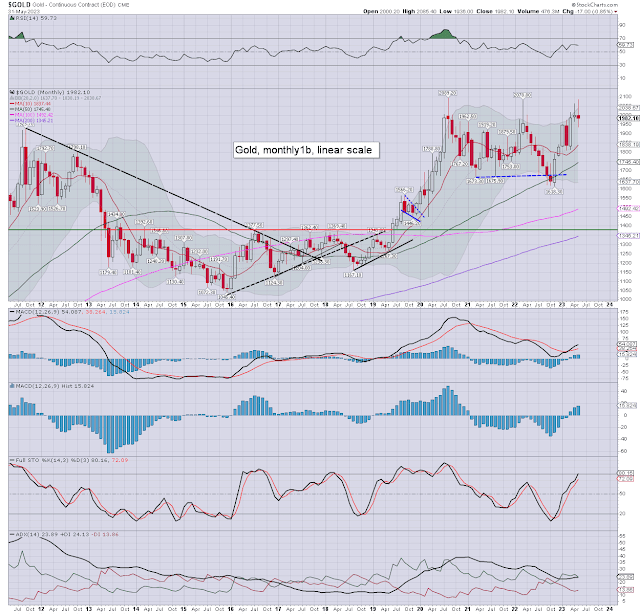

Gold, monthly1b

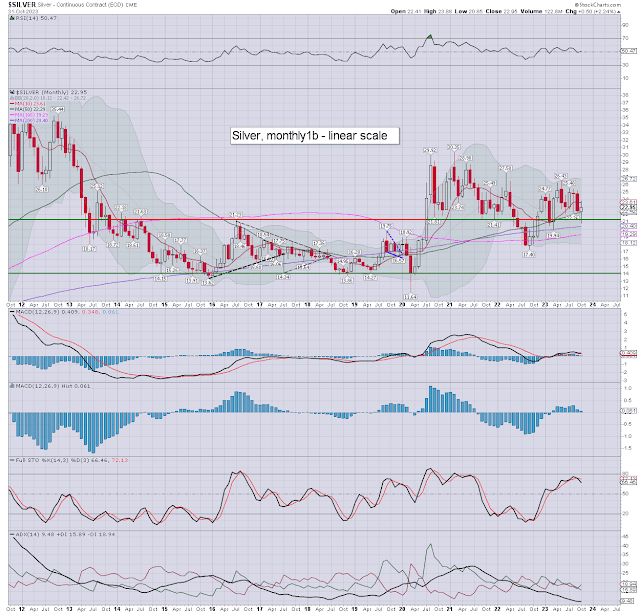

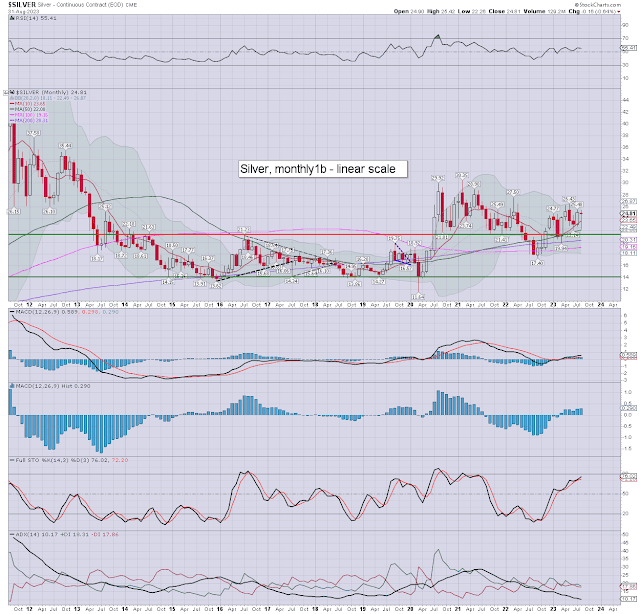

Silver, monthly1b

Summary

Gold: ending the year on a positive note, printing a new historic high of $2152.30, and settling at $2071.80, the highest ever monthly AND annual settlement. Price momentum ticked upward for a third month. I would note the monthly 10MA at $1986, which was settled decisively above, as the m/t trend is bullish.

Having printed >$2100, I see the door wide open to next resistance of the 2400/2500 zone, which is an area a fair few others are also seeking.

--

Silver: Printing $26.34, but cooling back to settle at $24.09. The

December candle is messy, offering no clear direction into early 2024. Momentum ticked back lower, if remaining marginally positive.

I would note the monthly 10MA at $24.09, which silver settled precisely on.

The silver bulls should be seeking a monthly settlement above $26.00. The problem will be if the main market sees any kind of cooling/retrace within Q1. Further downward pressures would be if the dollar strengthens, or if bond yields climb. Right now, there is zero sign to expect any such problems.

Silver bulls should remain seeking a decisive monthly close >$30.00. That doesn't look viable any earlier than end Feb'. Any talk of new historic highs >$50.00 has to be seen as 'crazy talk', until a settlement >$30.00.

--

Superior gold

I will continue to see gold as the superior, not least as it would better capture a geo-political 'fear bid', as appears a very high threat in summer/fall of 2024.

I would agree that upside potential - as a percentage, is vastly higher in silver. I'm very open to an eventual push >$50, and to triple digits. For now though, the cautious would arguably favour gold, whilst the bold would have a mixed holding, if leaning toward gold.

--

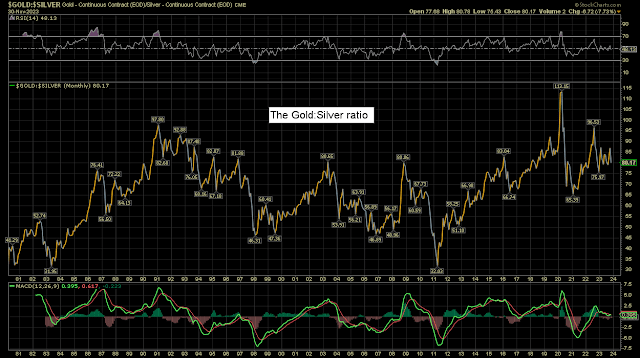

The gold to silver ratio stands at 86.02, which remains historically high. A

valid natural target would be the 32s, as silver could be expected to

outperform gold on a multi-year basis.

--

The gold to bitcoin ratio stands at 20.45, the highest since spring 2022, as crypto has outperformed gold since the main market floored in Oct'2022.

--

Gold was partly helped in 2023, by a weaker USD, which saw a net 2023 decline of -224bps (2.2%) to DXY 101.03. I'd note that the US 10yr yield settled precisely u/c for the year at 3.88%.

--

The Dow to gold ratio stands at 18.19. I'd note the Dot com bubble, where it took 41 to 42 one ounce gold coins to purchase the Dow.

However, its a 'quirky' ratio at best, and I'd be very cautious in reading anything from it. The ratio could broadly stay the same for years, whilst equities and gold trade higher, lower, or just flat-line.

-

Something I noticed just a few days ago.

Highly recommended. Get a coffee or something.

--

For more of the same...

For details and the latest offers > https://www.tradingsunset.com