The precious metals of Gold and Silver saw net September gains of +$131.80 (5.2%) to $2659.40, and +$2.32 (7.9%) to $31.46 respectively.

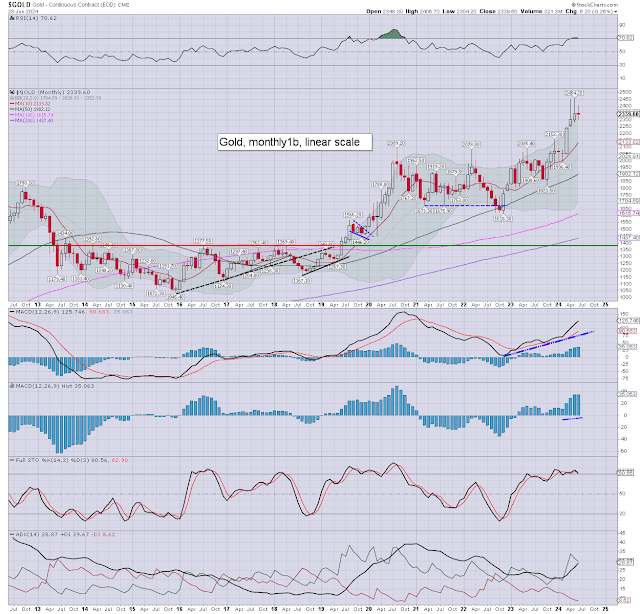

Gold, monthly1b

Silver, monthly1b

Summary

Gold: A new historic high of $2708.70, if cooling back to settle in the $2659s. The sixth net monthly gain of seven. Price momentum ticked upward, and is on the very high side. I would note the

monthly 10MA at $2308, which was settled above, as the m/t

trend is bullish. A hit of giant psy' 3K remains on track before year end.

--

Silver: a September high of $33.02, but cooling back to $31.46. The fifth monthly gain of seven. Momentum ticked back upward, and remains on the moderately high side.

I would note the monthly 10MA at $27.12, which was settled above, as the m/t trend is bullish.

The problem will be if the equity market sees any cooling into year end. Further downward pressures would be if the dollar strengthens, or if bond yields rebound.

--

The gold-bitcoin ratio stands at 23.91, as gold slightly outperformed bitcoin in September.

-

The gold-silver ratio stands at 84.54... and remains historically high. I'd accept that on a very long term basis (5+ years) silver could be expected to outperform gold.

As ever, ratio charts should be especially treated with caution. Whilst September's ratio leaned a little in favour to silver, both commodities were powerfully higher for the month. Price action is far more important than any ratio.

-

For more of the same...

Subscription offers > https://www.tradingsunset.com