The precious metals of Gold and Silver saw net November declines of -$7.40 (1.5%) to

$1776.50, and -$1.13

(4.7%) to

$22.82 respectively.

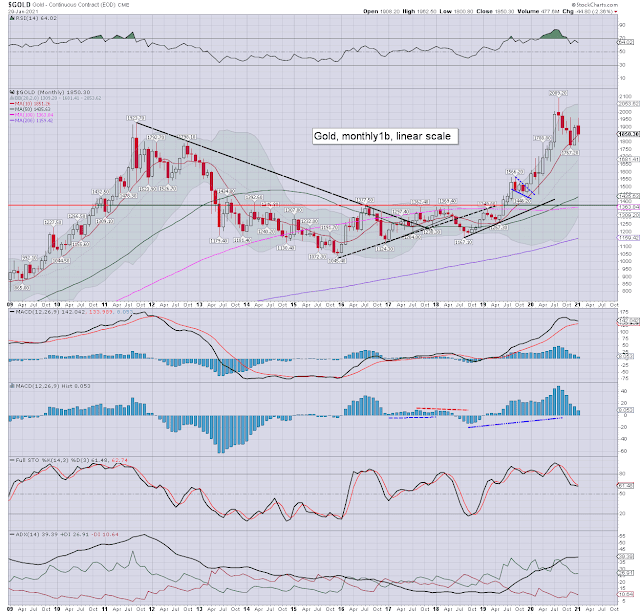

Gold, monthly1b

Silver, monthly1b

Summary

Gold: printing $1879.50, but cooling back into end month, settling in the $1776s. Price momentum is flat-lining, remaining on the moderately low side. The November candle doesn't offer a short/mid term floor. I would note the monthly 10MA at $1784. For bullish confidence, gold bugs need to see a monthly settlement >$1850, which looks feasible in December.Silver: printing $25.49, but cooling back to $22.82 Momentum ticked lower for a sixth consecutive month, and is on the moderately negative side. I would note the monthly 10MA at $24.94, which silver settled below. Price action has been a broad chop fest since August 2020. Things turn decisive for the silver bulls, with a break AND hold above $25.50.

For more of the same...