The precious metals of Gold and Silver saw net December gains of +$66.30 (3.8%) to $1826.20, and +$2.26 (10.4%) to $24.04 respectively. For the year, Gold and Silver saw net yearly changes of -$2.40 (0.1%) and +$0.69 (2.9%) respectively.

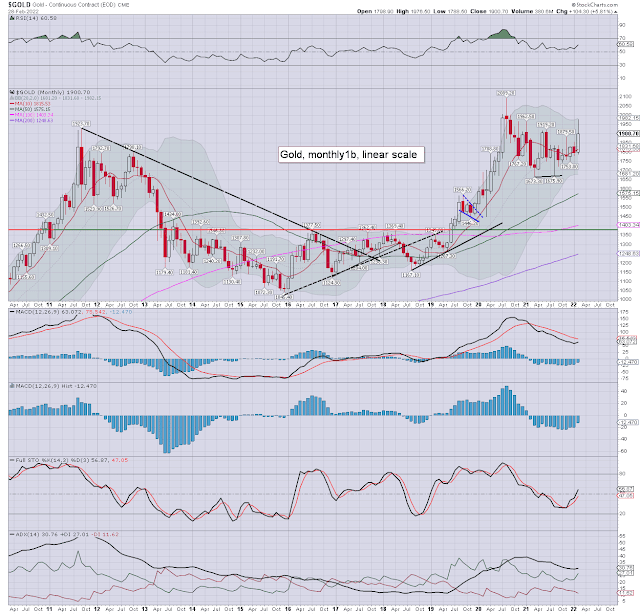

Gold, monthly1b

Silver, monthly1b

Summary

Gold: ending the year on a positive note, settling in the $1826s. Price momentum ticked higher for a second month, if remaining on the

moderately low side. The December candle offers increased confidence of a short term floor from the November $1618s. I would note the

monthly 10MA at $1792, which was settled above.

Silver: a fourth consecutive net monthly gain, printing $24.51, and settling at $24.04. The

December candle leans

s/t bullish. Momentum ticked higher for a fourth consecutive month, and is prone to turning positive in January.

I would note the monthly 10MA at $21.23, which silver settled decisively above. The silver bulls should be seeking a monthly settlement above $25.50.

The problem... especially for silver, will be if the main market is broadly lower across Q1. A further downward pressure will be if the dollar resumes broadly upward.

-

The gold to silver ratio stands at 75.97, which remains historically high. A valid natural target would be the 32s, as silver could be expected to outperform gold in an inflationary environment.

-

The gold to bitcoin ratio stands at 9.08, the lowest since autumn 2020. It sure would be interesting to see parity in this pair!

-

Considering the broadly stronger USD - a net 2022 gain of +768bps to DXY 103.27, Gold fared better in 2022 than it might at first seem. Both can rise together, especially in times of geo-political crisis.

--

For more of the same...

For details and the latest offers > https://www.tradingsunset.com