Gold and Silver ended the year on a positive note, settling net higher for the week by 2.4% and 4.3% respectively. For December, Gold and Silver saw net gains of 2.5% and 4.1% respectively. For 2017, Gold and Silver saw significant net gains of 13.7% and 7.2% respectively.

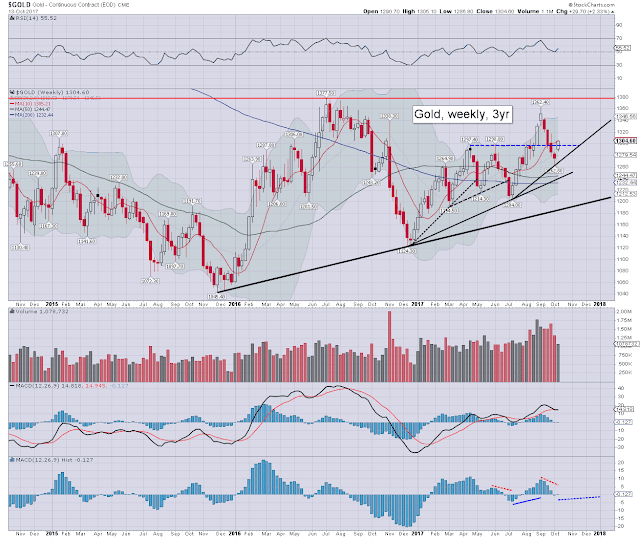

Gold weekly

Gold monthly1b

Silver weekly

Silver monthly1b

Summary

The precious metals certainly ended the year on a very positive note, with a third consecutive week of gains. This made for a sig' net monthly gain. More broadly, after gains into the spring, it was mostly a year of chop.

On a grand perspective, it should be clear that things would turn decisively bullish if Gold >$1400s, and Silver >$22s.

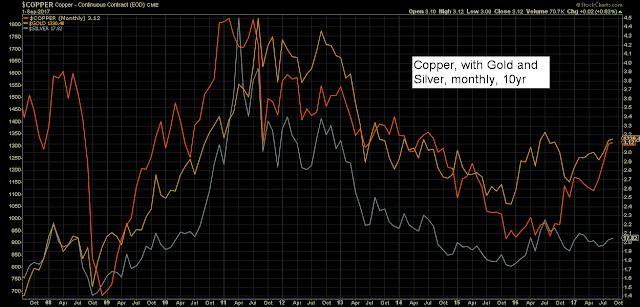

I am heavily leaning to the notion that 'Mr inflation is out there'. We are seeing indirect support for that view via copper and oil.

Eyes on the CRB...

Any price action >197 would be highly suggestive gold/silver will follow upward in 2018.

Friday, 29 December 2017

Friday, 22 December 2017

A second weekly gain

The precious metals of Gold and Silver climbed for a second week, with

net weekly gains of $21.30 (1.7%) to $1278.80, and $0.38 (2.4%) to

$16.44 respectively. Near term outlook is leaning bullish into year end.

Gold weekly

Silver weekly

Summary

So, a second consecutive net weekly gain, but broadly, its been a year of chop for Gold and Silver. For bullish clarity, the gold bugs need to see Gold >$1400 and Silver >$22.00.

Again, I would keep in mind copper, which saw a net weekly gain of 3.3%. Further, across the years, gold, silver, and copper do broadly trade together...

I am seeking Copper $4s for 2018. By definition, that does sway me to eventually seeing Gold and Silver follow.

Gold weekly

Silver weekly

Summary

So, a second consecutive net weekly gain, but broadly, its been a year of chop for Gold and Silver. For bullish clarity, the gold bugs need to see Gold >$1400 and Silver >$22.00.

Again, I would keep in mind copper, which saw a net weekly gain of 3.3%. Further, across the years, gold, silver, and copper do broadly trade together...

I am seeking Copper $4s for 2018. By definition, that does sway me to eventually seeing Gold and Silver follow.

Friday, 15 December 2017

Lower highs and lower lows

The precious metals of Gold and Silver caught a bounce, with

net weekly gains of $9.10 (0.7%) to $1257.50, and $0.24 (1.5%) to

$16.06 respectively. With a recent series of lower highs and lower lows, near term outlook offers little more than chop into year end.

Gold weekly

Silver weekly

Summary

So, a net weekly gain for Gold and Silver, but seen in perspective, the metals have been broadly struggling since September.. which was a failure to clear major resistance.

With just 9 trading days left of the year, there is little reason to expect much change. Gold is set for a sig' net yearly gain, but its possible Silver might settle net lower.

M/t outlook is 'mixed'. The one indirect bullish signal is copper, which after a brief break lower, looks set for another monthly close above the key $3.00 threshold.

Copper, gold, silver, monthly, 10yr

What should be clear, across the years, the trio do broadly trade together.

Gold weekly

Silver weekly

Summary

So, a net weekly gain for Gold and Silver, but seen in perspective, the metals have been broadly struggling since September.. which was a failure to clear major resistance.

With just 9 trading days left of the year, there is little reason to expect much change. Gold is set for a sig' net yearly gain, but its possible Silver might settle net lower.

M/t outlook is 'mixed'. The one indirect bullish signal is copper, which after a brief break lower, looks set for another monthly close above the key $3.00 threshold.

Copper, gold, silver, monthly, 10yr

What should be clear, across the years, the trio do broadly trade together.

Friday, 8 December 2017

A third week lower

It was a third week lower for the precious metals of Gold and Silver,

with

net weekly declines of -$33.90 (2.6%) to $1248.40, and -$0.57 (3.4%) to

$15.82 respectively. Near term outlook offers further weakness, not

least if the USD continues to climb across the latter half of December.

Gold weekly

Silver weekly

Summary

A third week lower, as the s/t bearish trend from mid November continues. Silver is leading the way lower, and technically.. its becoming outright ugly.

Gold has broken the upward trend from Dec'2016. The last remaining support is rising trend from the multi-year low of Dec'2015.

Lets be clear... Silver broke this summer, has has failed to recover. Gold is following. If Gold sees a monthly close <$1200, whether Dec'2017 (unlikely), or a more viable January, it would bode EXTREMELY bearish, and offer a new multi-month down wave.

Under $1200, its mostly empty air to the Dec'2015 low of $1045.40.

If we do see a break, horrific implications for the related mining stocks, whether large, mid, or small cap'.

Gold weekly

Silver weekly

Summary

A third week lower, as the s/t bearish trend from mid November continues. Silver is leading the way lower, and technically.. its becoming outright ugly.

Gold has broken the upward trend from Dec'2016. The last remaining support is rising trend from the multi-year low of Dec'2015.

Lets be clear... Silver broke this summer, has has failed to recover. Gold is following. If Gold sees a monthly close <$1200, whether Dec'2017 (unlikely), or a more viable January, it would bode EXTREMELY bearish, and offer a new multi-month down wave.

Under $1200, its mostly empty air to the Dec'2015 low of $1045.40.

If we do see a break, horrific implications for the related mining stocks, whether large, mid, or small cap'.

Friday, 1 December 2017

Weak metals

It was a week of weakness for the precious metals of Gold and Silver,

with

net weekly declines of -$5.00 (0.4%) to $1282.30, and -$0.60 (3.5%) to

$16.39 respectively. Near term outlook offers further weakness, not

least if the USD has even a moderate bounce across December.

Gold weekly

Silver weekly

Summary

Suffice to add... gold is still broadly choppy. Silver has seen a rather decisive bearish break lower. That sure doesn't bode well for Gold in the immediate term. Further, copper saw a net weekly decline of -2.4%.

S/t bearish... not least in Silver and Copper.

... implications for the related mining stocks.

Gold weekly

Silver weekly

Summary

Suffice to add... gold is still broadly choppy. Silver has seen a rather decisive bearish break lower. That sure doesn't bode well for Gold in the immediate term. Further, copper saw a net weekly decline of -2.4%.

S/t bearish... not least in Silver and Copper.

... implications for the related mining stocks.

Friday, 24 November 2017

Choppy metals

It was a week of chop for the precious metals of Gold and Silver, with

net weekly declines of -$9.20 (0.7%) to $1287.30, and -$0.38 (2.2%) to

$16.99 respectively. Near term outlook offers further weakness, not least if the USD has even a moderate bounce into early December.

Gold weekly

Silver weekly

Summary

Nothing to add from recent weeks.

Gold weekly

Silver weekly

Summary

Nothing to add from recent weeks.

Friday, 17 November 2017

Metals battling upward

It was a bullish week for the precious metals of Gold and Silver, with

net weekly gains of +$22.30 (1.7%) to $1296.50, and +$0.50 (3.0%) to

$17.37 respectively. Near term outlook offers further upside, not least if the USD stays below the DXY 95.00 threshold.

Gold weekly

Silver weekly

Summary

Suffice to add... nothing has changed.

I hold to the notion that 'Mr inflation is lurking'. Copper saw a key Aug' close >$3.00, confirmed in Oct'.

Copper, gold, silver - monthly, 10yr

The trio of metals do broadly trade together on a multi-year basis. If you believe copper will continue to claw upward into, and across much of 2018, then gold and silver should be expected to follow to some extent.

*if correct, bullish implications for the related mining stocks.

Gold weekly

Silver weekly

Summary

Suffice to add... nothing has changed.

I hold to the notion that 'Mr inflation is lurking'. Copper saw a key Aug' close >$3.00, confirmed in Oct'.

Copper, gold, silver - monthly, 10yr

The trio of metals do broadly trade together on a multi-year basis. If you believe copper will continue to claw upward into, and across much of 2018, then gold and silver should be expected to follow to some extent.

*if correct, bullish implications for the related mining stocks.

Friday, 10 November 2017

Minor weekly gains

It was a moderately bullish week for the precious metals of Gold and Silver, with

net weekly gains of + $5.00 (0.4%) to $1274.20, and +$0.04 (0.2%) to

$16.87 respectively. Near term outlook offers further choppy weakness, not least if the USD claws a little further upward.

Gold weekly

Silver weekly

Summary

Suffice to add, gold remains far stronger than silver.

Key thresholds: Gold $1400s, Silver $22s, with Copper $3.00s.

--

The three metals do broadly trade together, and it remains my view that if copper does push upward into and across 2018, that gold and silver will eventually follow.

Copper, gold, silver, monthly

Gold weekly

Silver weekly

Summary

Suffice to add, gold remains far stronger than silver.

Key thresholds: Gold $1400s, Silver $22s, with Copper $3.00s.

--

The three metals do broadly trade together, and it remains my view that if copper does push upward into and across 2018, that gold and silver will eventually follow.

Copper, gold, silver, monthly

Friday, 3 November 2017

Metals settling fractionally mixed

It was a mixed week for the precious metals of Gold and Silver, with

net weekly changes of -$2.60 (0.2%) to $1269.20, and +$0.08 (0.5%) to

$16.83 respectively. Near term outlook offers further choppy weakness, not least if the USD continues to claw upward.

Gold weekly

Silver weekly

Summary

Gold was lower for a third week, but is still holding well above the m/t bullish trend from the key multi-year low of Dec'2015. Provisional alarm bells should sound with any daily closes <1250, and it won't take much to see that occur. Things turn outright bearish if (at year end), Gold is trading <1200.

Do I expect that? No. Why? I see indirect strength via copper, oil, and a number of other commodities.

Silver remains far weaker than gold, and is far below the April high of $18.66. The outlook would turn VERY bearish for silver with any daily closes <15.60. For the record, I don't expect that.

--

*As ever, the price action in Gold and Silver will have powerful effects on the related mining stocks, which have been struggling lately.

Gold weekly

Silver weekly

Summary

Gold was lower for a third week, but is still holding well above the m/t bullish trend from the key multi-year low of Dec'2015. Provisional alarm bells should sound with any daily closes <1250, and it won't take much to see that occur. Things turn outright bearish if (at year end), Gold is trading <1200.

Do I expect that? No. Why? I see indirect strength via copper, oil, and a number of other commodities.

Silver remains far weaker than gold, and is far below the April high of $18.66. The outlook would turn VERY bearish for silver with any daily closes <15.60. For the record, I don't expect that.

--

*As ever, the price action in Gold and Silver will have powerful effects on the related mining stocks, which have been struggling lately.

Friday, 27 October 2017

Metals pressured via the USD

It was a second consecutive bearish week for the precious metals of Gold and Silver, with

net weekly declines of -$8.70 (0.7%) to $1271.80, and -$0.33 (1.9%) to

$16.75 respectively. Near term outlook offers further weakness, not least if the USD continues to claw upward.

Gold weekly

Silver weekly

Summary

Suffice to add, s/t bearish, but the indirect bullish aspect remains copper...

Copper weekly

With 2 trading days left of the month, copper is $3.10, and that should be enough to ensure an Oct' close >$3.00.

Gold weekly

Silver weekly

Summary

Suffice to add, s/t bearish, but the indirect bullish aspect remains copper...

Copper weekly

With 2 trading days left of the month, copper is $3.10, and that should be enough to ensure an Oct' close >$3.00.

Friday, 20 October 2017

Back on the slide

It was a bearish week for the precious metals of Gold and Silver, with

net weekly declines of -$24.10 (1.8%) to $1280.50, and -$0.33 (1.9%) to

$17.08 respectively. Near term outlook offers renewed upside, not least if the USD resumes lower, or on geo-political

upset.

Gold weekly

Silver weekly

Summary

Suffice to add, broader price action is very choppy. Gold is far stronger than Silver, although Copper is stronger than Gold.

Indirectly, the ongoing upward trend in copper from late 2016 bodes that Gold and Silver will eventually catch up, as the trio trade broadly together across the years...

Gold, Silver, Copper, monthly, 10yr

... and if the metals rally into 2018, its bodes extremely bullish for the related miners.

Gold weekly

Silver weekly

Summary

Suffice to add, broader price action is very choppy. Gold is far stronger than Silver, although Copper is stronger than Gold.

Indirectly, the ongoing upward trend in copper from late 2016 bodes that Gold and Silver will eventually catch up, as the trio trade broadly together across the years...

Gold, Silver, Copper, monthly, 10yr

... and if the metals rally into 2018, its bodes extremely bullish for the related miners.

Friday, 13 October 2017

Significant weekly gains

It was a bullish week for the precious metals of Gold and Silver, with

net weekly gains of $29.70 (2.3%) to $1304.60, and $0.62 (3.7%) to

$17.41 respectively. Near term outlook offers further upside, not least if the USD resumes lower, or on geo-political

upset.

Gold weekly

Silver weekly

Summary

Suffice to add... the metals are leaning upward, with gold notably stronger than silver.

Copper remains a powerfully bullish indirect signal. If copper can keep clawing upward, its near impossible not to see Gold, Silver, and the related miners eventually follow.

Key thresholds: Gold $1400s, Silver $22s, Copper $3.00 (achieved).

If gold and silver can meet those thresholds, it will have very bullish mid/long term implications for the related mining stocks.

Gold weekly

Silver weekly

Summary

Suffice to add... the metals are leaning upward, with gold notably stronger than silver.

Copper remains a powerfully bullish indirect signal. If copper can keep clawing upward, its near impossible not to see Gold, Silver, and the related miners eventually follow.

Key thresholds: Gold $1400s, Silver $22s, Copper $3.00 (achieved).

If gold and silver can meet those thresholds, it will have very bullish mid/long term implications for the related mining stocks.

Friday, 6 October 2017

A mixed week for gold and silver

It was a mixed week for the precious metals of Gold and Silver, with net weekly changes of -$9.90 (0.8%) to $1274.90, and +$0.11 (0.7%) to $16.79 respectively. Near term outlook offers some chop,

but high threat of

renewed upside, not least if the USD resumes lower, or on geo-political

upset.

Gold weekly

Silver weekly

Summary

Gold: a fourth consecutive net weekly decline. Underlying MACD (blue bar histogram) cycle has turned fractionally negative for the first time since late July. First soft support is at $1220/10. Core rising trend from Dec'2015 currently offers support in the $1180s.

Silver: a moderate net weekly gain, and notably still lagging gold and copper. Underlying MACD cycle remains fractionally positive. Things really only turn bullish if the Feb/April highs are broken back above, and that is at least 2-3 months away.

--

*it remains the case that copper is leading gold and silver. The August copper settlement >$3.00 was very bullish, and bodes that Gold and Silver will eventually catch up.

Key thresholds: Gold $1400, Silver $22s, and Copper $3.00 (achieved).

Gold weekly

Silver weekly

Summary

Gold: a fourth consecutive net weekly decline. Underlying MACD (blue bar histogram) cycle has turned fractionally negative for the first time since late July. First soft support is at $1220/10. Core rising trend from Dec'2015 currently offers support in the $1180s.

Silver: a moderate net weekly gain, and notably still lagging gold and copper. Underlying MACD cycle remains fractionally positive. Things really only turn bullish if the Feb/April highs are broken back above, and that is at least 2-3 months away.

--

*it remains the case that copper is leading gold and silver. The August copper settlement >$3.00 was very bullish, and bodes that Gold and Silver will eventually catch up.

Key thresholds: Gold $1400, Silver $22s, and Copper $3.00 (achieved).

Friday, 29 September 2017

The metals cool in September

The precious metals of Gold and Silver

saw net monthly declines of -$37.40 (2.8%) to $1284.80, and -$0.90 (5.1%) to $16.68 respectively. Near term outlook offers some weak chop, but high threat of

renewed upside, not least if the USD resumes lower, or on geo-political

upset.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a bearish September for gold and silver, but broadly... the metals have both been churning across the year. Gold is clearly stronger than Silver.

Key thresholds for 'bullish confidence': Gold $1400, Silver $22, Copper $3.00 (achieved)

--

Keep in mind copper, which despite settling net lower for Sept' by -4.6% to $2.95, that doesn't negate the powerfully bullish August close >$3.00. The trio of gold, silver, and copper do trade together across the years...

... and copper is suggestive gold and silver will eventually catch up into 2018.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a bearish September for gold and silver, but broadly... the metals have both been churning across the year. Gold is clearly stronger than Silver.

Key thresholds for 'bullish confidence': Gold $1400, Silver $22, Copper $3.00 (achieved)

--

Keep in mind copper, which despite settling net lower for Sept' by -4.6% to $2.95, that doesn't negate the powerfully bullish August close >$3.00. The trio of gold, silver, and copper do trade together across the years...

... and copper is suggestive gold and silver will eventually catch up into 2018.

Friday, 22 September 2017

A second week lower

The precious metals saw a second week of cooling. Gold and Silver settled sig'

lower by -$27.70 (2.1%) to $1297.50, and -$0.72 (4.0%) to $16.98 respectively. Near term outlook offers a little chop, but high threat of renewed upside, not least if the USD resumes lower, or on geo-political upset.

Gold weekly

Silver weekly

Summary

So, a second week lower. Most notable was Gold settling the week under the psy level of $1300. That should concern the gold bugs at least a little!

Note the underlying MACD (blue bar histogram) cycles. Gold and Silver both ticked lower for a second week. At the current rate, a bearish cross will be due at the Monday Oct'2nd open.

Key thresholds: Gold $1400, Silver $22s.

--

Copper continues to offer a strong indirect bullish signal.

Copper settled net lower for a third consecutive week, but the August settlement >$3.00 was an exceptionally bullish aspect. So long as copper holds above rising trend (currently around $2.70), the outlook is bullish.

Gold weekly

Silver weekly

Summary

So, a second week lower. Most notable was Gold settling the week under the psy level of $1300. That should concern the gold bugs at least a little!

Note the underlying MACD (blue bar histogram) cycles. Gold and Silver both ticked lower for a second week. At the current rate, a bearish cross will be due at the Monday Oct'2nd open.

Key thresholds: Gold $1400, Silver $22s.

--

Copper continues to offer a strong indirect bullish signal.

Copper settled net lower for a third consecutive week, but the August settlement >$3.00 was an exceptionally bullish aspect. So long as copper holds above rising trend (currently around $2.70), the outlook is bullish.

Friday, 15 September 2017

Gold and Silver cooling

After three weeks of rather strong gains, the precious metals saw a week of cooling. Gold and Silver settled sig' lower by -$26.00 (1.9%) to $1325.20, and -$0.42 (2.3%) to $17.70 respectively. Near term outlook offers a little chop ahead of the Sept'20th FOMC, before resuming upward.

Gold, weekly

Silver, weekly

Summary

Its notable the USD - a key variable, settled net higher for the week, +0.4% to DXY 91.65. In the scheme of things, its a small gain, and certainly can't account for more than a fraction of this week's declines in gold and silver.

As ever.. few things go straight up. For now, Gold and Silver are holding a rather strong upward trend from the July lows of $1204 and $14.24. Gold is already close to the summer 2016 high, whilst silver is lagging... yet to clear the Feb/April highs.

An indirect bullish aspect for gold and silver is copper, which saw a powerful bullish August close above the $3.00 threshold.

Copper is leading the way, and unless it breaks back under rising trend - currently around $2.70, gold and silver can be expected to follow, and broadly climb into early 2018.

Gold, weekly

Silver, weekly

Summary

Its notable the USD - a key variable, settled net higher for the week, +0.4% to DXY 91.65. In the scheme of things, its a small gain, and certainly can't account for more than a fraction of this week's declines in gold and silver.

As ever.. few things go straight up. For now, Gold and Silver are holding a rather strong upward trend from the July lows of $1204 and $14.24. Gold is already close to the summer 2016 high, whilst silver is lagging... yet to clear the Feb/April highs.

An indirect bullish aspect for gold and silver is copper, which saw a powerful bullish August close above the $3.00 threshold.

Copper is leading the way, and unless it breaks back under rising trend - currently around $2.70, gold and silver can be expected to follow, and broadly climb into early 2018.

Saturday, 9 September 2017

A third week higher

It was another week of gains for the precious metals. Gold and Silver saw net gains of $20.80 (1.6%) to $1351.20, and $0.31 (1.7%) to $18.12. Near term outlook is bullish, especially for Gold. Silver is still battling to clear the Feb/April highs.

Gold, weekly

Silver, weekly

Summary

Suffice to note, the weakness in the USD is unquestionably helping push the metals upward.

USD, weekly

With the DXY 93 threshold failing to hold as support, the next big level are the 88/87s. Even at the current rate of decline, that won't be seen until at least the very tail end of the year.

--

Gold and Silver are seeing a strong run from the early July lows. Gold is catching (naturally) a particularly strong fear bid, and is close to the summer 2016 high of $1377.50. Silver is still lagging, yet to break the Feb/April highs.

A bullish indirect indicator is copper, which saw a powerfully bullish August settlement above the key $3.00 threshold.

Despite weakness into the weekend - with a notable bearish engulfing weekly candle, copper does bode bullish for Gold and Silver in the weeks and months ahead. The view is only dropped if copper <2.75... and that number is raised each week.

Gold, weekly

Silver, weekly

Summary

Suffice to note, the weakness in the USD is unquestionably helping push the metals upward.

USD, weekly

With the DXY 93 threshold failing to hold as support, the next big level are the 88/87s. Even at the current rate of decline, that won't be seen until at least the very tail end of the year.

--

Gold and Silver are seeing a strong run from the early July lows. Gold is catching (naturally) a particularly strong fear bid, and is close to the summer 2016 high of $1377.50. Silver is still lagging, yet to break the Feb/April highs.

A bullish indirect indicator is copper, which saw a powerfully bullish August settlement above the key $3.00 threshold.

Despite weakness into the weekend - with a notable bearish engulfing weekly candle, copper does bode bullish for Gold and Silver in the weeks and months ahead. The view is only dropped if copper <2.75... and that number is raised each week.

Friday, 1 September 2017

A second week higher

The precious metals climbed for a second consecutive week, with Gold and Silver settling net higher by $32.50 (2.5%) to $1330.40, and $0.77 (4.5%) to $17.82 respectively. Near term outlook offers further upside to challenge the summer 2016 highs.

Gold weekly

Silver weekly

Summary

Suffice to add, September has started on a positive note. More broadly, Gold remains much stronger than Silver, having achieved a decisive monthly close above the $1300 threshold - above the April/June high. Silver is still lagging, well below the Feb/April high.

--

A powerful indirect signal for Gold and Silver is copper, which has just recently achieved the first monthly close >$3.00 since Aug'2014.

Copper, gold, silver - monthly, 10yr

The trio of Gold, Silver, and Copper trade broadly together across the years, and copper is unquestionably leading the way higher.

Gold weekly

Silver weekly

Summary

Suffice to add, September has started on a positive note. More broadly, Gold remains much stronger than Silver, having achieved a decisive monthly close above the $1300 threshold - above the April/June high. Silver is still lagging, well below the Feb/April high.

--

A powerful indirect signal for Gold and Silver is copper, which has just recently achieved the first monthly close >$3.00 since Aug'2014.

Copper, gold, silver - monthly, 10yr

The trio of Gold, Silver, and Copper trade broadly together across the years, and copper is unquestionably leading the way higher.

Subscribe to:

Comments (Atom)