The precious metals of Gold and Silver

saw net monthly declines of -$37.40 (2.8%) to $1284.80, and -$0.90 (5.1%) to $16.68 respectively. Near term outlook offers some weak chop, but high threat of

renewed upside, not least if the USD resumes lower, or on geo-political

upset.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a bearish September for gold and silver, but broadly... the metals have both been churning across the year. Gold is clearly stronger than Silver.

Key thresholds for 'bullish confidence': Gold $1400, Silver $22, Copper $3.00 (achieved)

--

Keep in mind copper, which despite settling net lower for Sept' by -4.6% to $2.95, that doesn't negate the powerfully bullish August close >$3.00. The trio of gold, silver, and copper do trade together across the years...

... and copper is suggestive gold and silver will eventually catch up into 2018.

Friday, 29 September 2017

Friday, 22 September 2017

A second week lower

The precious metals saw a second week of cooling. Gold and Silver settled sig'

lower by -$27.70 (2.1%) to $1297.50, and -$0.72 (4.0%) to $16.98 respectively. Near term outlook offers a little chop, but high threat of renewed upside, not least if the USD resumes lower, or on geo-political upset.

Gold weekly

Silver weekly

Summary

So, a second week lower. Most notable was Gold settling the week under the psy level of $1300. That should concern the gold bugs at least a little!

Note the underlying MACD (blue bar histogram) cycles. Gold and Silver both ticked lower for a second week. At the current rate, a bearish cross will be due at the Monday Oct'2nd open.

Key thresholds: Gold $1400, Silver $22s.

--

Copper continues to offer a strong indirect bullish signal.

Copper settled net lower for a third consecutive week, but the August settlement >$3.00 was an exceptionally bullish aspect. So long as copper holds above rising trend (currently around $2.70), the outlook is bullish.

Gold weekly

Silver weekly

Summary

So, a second week lower. Most notable was Gold settling the week under the psy level of $1300. That should concern the gold bugs at least a little!

Note the underlying MACD (blue bar histogram) cycles. Gold and Silver both ticked lower for a second week. At the current rate, a bearish cross will be due at the Monday Oct'2nd open.

Key thresholds: Gold $1400, Silver $22s.

--

Copper continues to offer a strong indirect bullish signal.

Copper settled net lower for a third consecutive week, but the August settlement >$3.00 was an exceptionally bullish aspect. So long as copper holds above rising trend (currently around $2.70), the outlook is bullish.

Friday, 15 September 2017

Gold and Silver cooling

After three weeks of rather strong gains, the precious metals saw a week of cooling. Gold and Silver settled sig' lower by -$26.00 (1.9%) to $1325.20, and -$0.42 (2.3%) to $17.70 respectively. Near term outlook offers a little chop ahead of the Sept'20th FOMC, before resuming upward.

Gold, weekly

Silver, weekly

Summary

Its notable the USD - a key variable, settled net higher for the week, +0.4% to DXY 91.65. In the scheme of things, its a small gain, and certainly can't account for more than a fraction of this week's declines in gold and silver.

As ever.. few things go straight up. For now, Gold and Silver are holding a rather strong upward trend from the July lows of $1204 and $14.24. Gold is already close to the summer 2016 high, whilst silver is lagging... yet to clear the Feb/April highs.

An indirect bullish aspect for gold and silver is copper, which saw a powerful bullish August close above the $3.00 threshold.

Copper is leading the way, and unless it breaks back under rising trend - currently around $2.70, gold and silver can be expected to follow, and broadly climb into early 2018.

Gold, weekly

Silver, weekly

Summary

Its notable the USD - a key variable, settled net higher for the week, +0.4% to DXY 91.65. In the scheme of things, its a small gain, and certainly can't account for more than a fraction of this week's declines in gold and silver.

As ever.. few things go straight up. For now, Gold and Silver are holding a rather strong upward trend from the July lows of $1204 and $14.24. Gold is already close to the summer 2016 high, whilst silver is lagging... yet to clear the Feb/April highs.

An indirect bullish aspect for gold and silver is copper, which saw a powerful bullish August close above the $3.00 threshold.

Copper is leading the way, and unless it breaks back under rising trend - currently around $2.70, gold and silver can be expected to follow, and broadly climb into early 2018.

Saturday, 9 September 2017

A third week higher

It was another week of gains for the precious metals. Gold and Silver saw net gains of $20.80 (1.6%) to $1351.20, and $0.31 (1.7%) to $18.12. Near term outlook is bullish, especially for Gold. Silver is still battling to clear the Feb/April highs.

Gold, weekly

Silver, weekly

Summary

Suffice to note, the weakness in the USD is unquestionably helping push the metals upward.

USD, weekly

With the DXY 93 threshold failing to hold as support, the next big level are the 88/87s. Even at the current rate of decline, that won't be seen until at least the very tail end of the year.

--

Gold and Silver are seeing a strong run from the early July lows. Gold is catching (naturally) a particularly strong fear bid, and is close to the summer 2016 high of $1377.50. Silver is still lagging, yet to break the Feb/April highs.

A bullish indirect indicator is copper, which saw a powerfully bullish August settlement above the key $3.00 threshold.

Despite weakness into the weekend - with a notable bearish engulfing weekly candle, copper does bode bullish for Gold and Silver in the weeks and months ahead. The view is only dropped if copper <2.75... and that number is raised each week.

Gold, weekly

Silver, weekly

Summary

Suffice to note, the weakness in the USD is unquestionably helping push the metals upward.

USD, weekly

With the DXY 93 threshold failing to hold as support, the next big level are the 88/87s. Even at the current rate of decline, that won't be seen until at least the very tail end of the year.

--

Gold and Silver are seeing a strong run from the early July lows. Gold is catching (naturally) a particularly strong fear bid, and is close to the summer 2016 high of $1377.50. Silver is still lagging, yet to break the Feb/April highs.

A bullish indirect indicator is copper, which saw a powerfully bullish August settlement above the key $3.00 threshold.

Despite weakness into the weekend - with a notable bearish engulfing weekly candle, copper does bode bullish for Gold and Silver in the weeks and months ahead. The view is only dropped if copper <2.75... and that number is raised each week.

Friday, 1 September 2017

A second week higher

The precious metals climbed for a second consecutive week, with Gold and Silver settling net higher by $32.50 (2.5%) to $1330.40, and $0.77 (4.5%) to $17.82 respectively. Near term outlook offers further upside to challenge the summer 2016 highs.

Gold weekly

Silver weekly

Summary

Suffice to add, September has started on a positive note. More broadly, Gold remains much stronger than Silver, having achieved a decisive monthly close above the $1300 threshold - above the April/June high. Silver is still lagging, well below the Feb/April high.

--

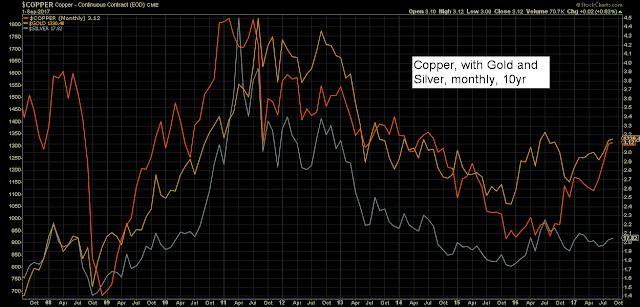

A powerful indirect signal for Gold and Silver is copper, which has just recently achieved the first monthly close >$3.00 since Aug'2014.

Copper, gold, silver - monthly, 10yr

The trio of Gold, Silver, and Copper trade broadly together across the years, and copper is unquestionably leading the way higher.

Gold weekly

Silver weekly

Summary

Suffice to add, September has started on a positive note. More broadly, Gold remains much stronger than Silver, having achieved a decisive monthly close above the $1300 threshold - above the April/June high. Silver is still lagging, well below the Feb/April high.

--

A powerful indirect signal for Gold and Silver is copper, which has just recently achieved the first monthly close >$3.00 since Aug'2014.

Copper, gold, silver - monthly, 10yr

The trio of Gold, Silver, and Copper trade broadly together across the years, and copper is unquestionably leading the way higher.

Subscribe to:

Comments (Atom)