It was a second consecutive bearish week for the precious metals of Gold and Silver, with

net weekly declines of -$8.70 (0.7%) to $1271.80, and -$0.33 (1.9%) to

$16.75 respectively. Near term outlook offers further weakness, not least if the USD continues to claw upward.

Gold weekly

Silver weekly

Summary

Suffice to add, s/t bearish, but the indirect bullish aspect remains copper...

Copper weekly

With 2 trading days left of the month, copper is $3.10, and that should be enough to ensure an Oct' close >$3.00.

Friday, 27 October 2017

Friday, 20 October 2017

Back on the slide

It was a bearish week for the precious metals of Gold and Silver, with

net weekly declines of -$24.10 (1.8%) to $1280.50, and -$0.33 (1.9%) to

$17.08 respectively. Near term outlook offers renewed upside, not least if the USD resumes lower, or on geo-political

upset.

Gold weekly

Silver weekly

Summary

Suffice to add, broader price action is very choppy. Gold is far stronger than Silver, although Copper is stronger than Gold.

Indirectly, the ongoing upward trend in copper from late 2016 bodes that Gold and Silver will eventually catch up, as the trio trade broadly together across the years...

Gold, Silver, Copper, monthly, 10yr

... and if the metals rally into 2018, its bodes extremely bullish for the related miners.

Gold weekly

Silver weekly

Summary

Suffice to add, broader price action is very choppy. Gold is far stronger than Silver, although Copper is stronger than Gold.

Indirectly, the ongoing upward trend in copper from late 2016 bodes that Gold and Silver will eventually catch up, as the trio trade broadly together across the years...

Gold, Silver, Copper, monthly, 10yr

... and if the metals rally into 2018, its bodes extremely bullish for the related miners.

Friday, 13 October 2017

Significant weekly gains

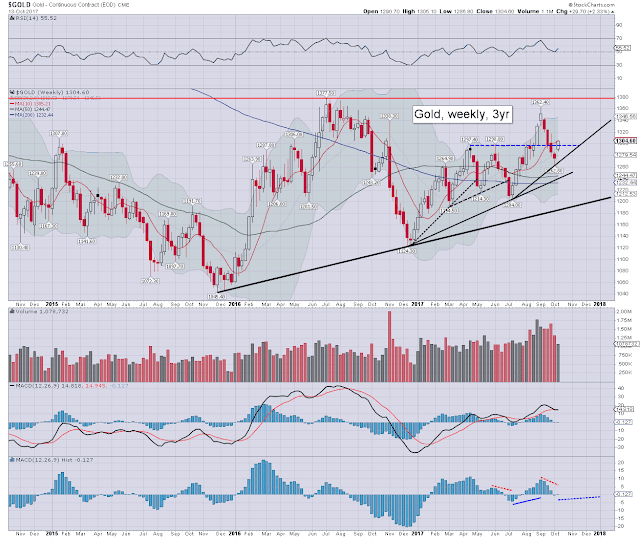

It was a bullish week for the precious metals of Gold and Silver, with

net weekly gains of $29.70 (2.3%) to $1304.60, and $0.62 (3.7%) to

$17.41 respectively. Near term outlook offers further upside, not least if the USD resumes lower, or on geo-political

upset.

Gold weekly

Silver weekly

Summary

Suffice to add... the metals are leaning upward, with gold notably stronger than silver.

Copper remains a powerfully bullish indirect signal. If copper can keep clawing upward, its near impossible not to see Gold, Silver, and the related miners eventually follow.

Key thresholds: Gold $1400s, Silver $22s, Copper $3.00 (achieved).

If gold and silver can meet those thresholds, it will have very bullish mid/long term implications for the related mining stocks.

Gold weekly

Silver weekly

Summary

Suffice to add... the metals are leaning upward, with gold notably stronger than silver.

Copper remains a powerfully bullish indirect signal. If copper can keep clawing upward, its near impossible not to see Gold, Silver, and the related miners eventually follow.

Key thresholds: Gold $1400s, Silver $22s, Copper $3.00 (achieved).

If gold and silver can meet those thresholds, it will have very bullish mid/long term implications for the related mining stocks.

Friday, 6 October 2017

A mixed week for gold and silver

It was a mixed week for the precious metals of Gold and Silver, with net weekly changes of -$9.90 (0.8%) to $1274.90, and +$0.11 (0.7%) to $16.79 respectively. Near term outlook offers some chop,

but high threat of

renewed upside, not least if the USD resumes lower, or on geo-political

upset.

Gold weekly

Silver weekly

Summary

Gold: a fourth consecutive net weekly decline. Underlying MACD (blue bar histogram) cycle has turned fractionally negative for the first time since late July. First soft support is at $1220/10. Core rising trend from Dec'2015 currently offers support in the $1180s.

Silver: a moderate net weekly gain, and notably still lagging gold and copper. Underlying MACD cycle remains fractionally positive. Things really only turn bullish if the Feb/April highs are broken back above, and that is at least 2-3 months away.

--

*it remains the case that copper is leading gold and silver. The August copper settlement >$3.00 was very bullish, and bodes that Gold and Silver will eventually catch up.

Key thresholds: Gold $1400, Silver $22s, and Copper $3.00 (achieved).

Gold weekly

Silver weekly

Summary

Gold: a fourth consecutive net weekly decline. Underlying MACD (blue bar histogram) cycle has turned fractionally negative for the first time since late July. First soft support is at $1220/10. Core rising trend from Dec'2015 currently offers support in the $1180s.

Silver: a moderate net weekly gain, and notably still lagging gold and copper. Underlying MACD cycle remains fractionally positive. Things really only turn bullish if the Feb/April highs are broken back above, and that is at least 2-3 months away.

--

*it remains the case that copper is leading gold and silver. The August copper settlement >$3.00 was very bullish, and bodes that Gold and Silver will eventually catch up.

Key thresholds: Gold $1400, Silver $22s, and Copper $3.00 (achieved).

Subscribe to:

Comments (Atom)