The precious metals of Gold and Silver saw net December gains of +$55.30 (4.5%) to $1281.30, and +$1.32

(9.3%) to

$15.54 respectively. For the year, Gold and Silver saw net declines of -2.1% and -9.4% respectively.

Gold monthly

Silver monthly

Summary

Gold: a third consecutive net monthly gain. MACD (blue bar histogram) cycle ticked upward. At the current rate, price momentum should turn outright positive by late January/early February. Things only turn decisively bullish >1400. If seen, it'd offer an eventual challenge of the Sept'2011 historic high of $1923.70.

Silver: a very powerful net monthly gain of 9.3%, although broadly.. Silver is struggling with most other commodities. Things only turn decisively bullish above psy' $20.00, and that is around 33% higher.

Monday, 31 December 2018

Thursday, 1 November 2018

Gold net higher

The precious metals of Gold and Silver saw net October changes of +$18.80 (1.6%) to $1215, and -$0.43

(2,9%) to

$14.28 respectively. Mid term outlook offers further downside, as US

rates are still regularly being raised, which should help to maintain a

broadly strong USD.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add... a net October gain for Gold, but that sure doesn't break the m/t bearish trend. Silver was weak, clearly pressured via the broadly strong USD in the DXY 96s.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add... a net October gain for Gold, but that sure doesn't break the m/t bearish trend. Silver was weak, clearly pressured via the broadly strong USD in the DXY 96s.

Friday, 28 September 2018

Gold lower for a sixth month

The precious metals of Gold and Silver saw net September changes of -$10.50 (0.9%) to $1196.20, and +$0.15

(1.1%) to

$14.71 respectively. Mid term outlook offers further downside, as US rates are regularly being raised, which should help to maintain a broadly strong USD.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a mixed month for the precious metals, with Gold seeing a sixth consecutive net monthly decline, whilst Silver saw a bounce.

By definition, every US rate hike is bearish for gold and silver, as it raises the carrying costs. The USD is a key variable of course, and its notable that gold still fell in September, despite a slightly weaker dollar.

As things are, another rate hike will be due Dec'19th, with another 3-4 in 2019. Further, the USD could be expected to remain broadly strong, certainly holding above the key DXY 88s.

--

*m/t bearish implications for the related gold miners.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a mixed month for the precious metals, with Gold seeing a sixth consecutive net monthly decline, whilst Silver saw a bounce.

By definition, every US rate hike is bearish for gold and silver, as it raises the carrying costs. The USD is a key variable of course, and its notable that gold still fell in September, despite a slightly weaker dollar.

As things are, another rate hike will be due Dec'19th, with another 3-4 in 2019. Further, the USD could be expected to remain broadly strong, certainly holding above the key DXY 88s.

--

*m/t bearish implications for the related gold miners.

Friday, 31 August 2018

Gold falls for a fifth month

The precious metals of Gold and Silver saw net August declines of -$26.90 (2.2%) to $1206.70, and -$1.12

(7.2%) to

$14.44 respectively. Mid term outlook offers further downside, not

least if the USD resumes upward to the DXY 100 threshold.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a pretty dire month for the precious metals. Gold fell for a fifth consecutive month, seeing a low of $1167.10. Next support is the Dec'2016 low of $1124.30. Silver cooled for a third month, settling at $14.44, the lowest monthly close since Jan'2016.

Frankly... the m/t outlook has to be bearish, not least as King dollar remains broadly strong. Legacy gold target of 900/875 looks viable in 2019. Each rate hike will raise the carrying costs for gold, and we should see two rate hikes in Sept' and Dec'.

Clearly, if gold/silver remain weak into 2019, the related mining stocks will be dragged lower. The monthly close for the ETF of GDX is certainly reflective of m/t weakness in gold/silver.

Gold monthly1b

Silver monthly1b

Summary

Suffice to add, it was a pretty dire month for the precious metals. Gold fell for a fifth consecutive month, seeing a low of $1167.10. Next support is the Dec'2016 low of $1124.30. Silver cooled for a third month, settling at $14.44, the lowest monthly close since Jan'2016.

Frankly... the m/t outlook has to be bearish, not least as King dollar remains broadly strong. Legacy gold target of 900/875 looks viable in 2019. Each rate hike will raise the carrying costs for gold, and we should see two rate hikes in Sept' and Dec'.

Clearly, if gold/silver remain weak into 2019, the related mining stocks will be dragged lower. The monthly close for the ETF of GDX is certainly reflective of m/t weakness in gold/silver.

Friday, 10 August 2018

Silver lower for a ninth week

The precious metals of Gold and Silver saw net weekly declines of -$4.20 (0.3%) to $1219.00, and -$0.17 (1.1%) to

$15.30 respectively. Near term outlook offers further downside, not least if the USD strengthens toward DXY 100. The m/t

outlook has turned very bearish, with Silver <$16s, and Gold having failed to hold the Dec'2017 low.

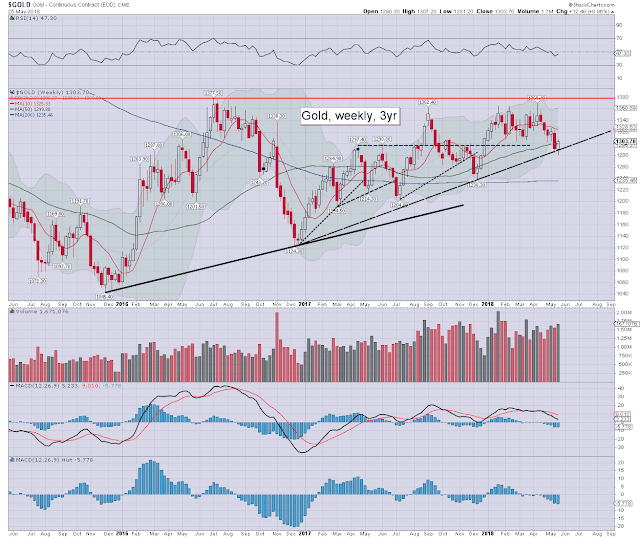

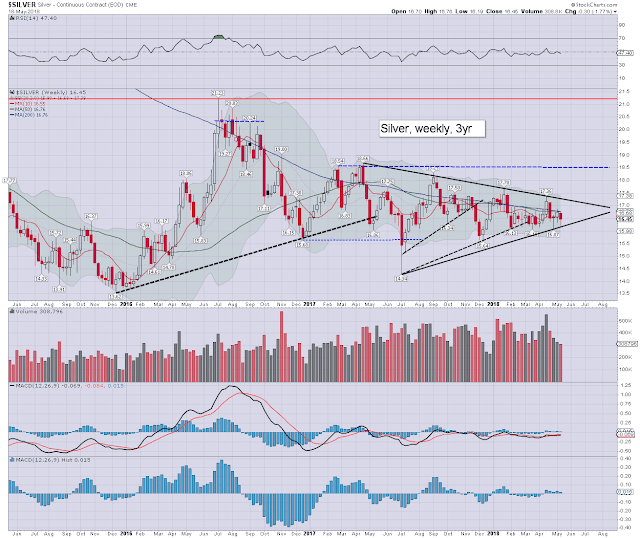

Gold weekly

Silver, weekly

Summary

A ninth consecutive net weekly decline for silver, the worse run in some years.

Gold settled net lower for the 12th week of 17. Cyclically, both metals are on the low side, and due a multi-week bounce. However, the m/t trend for both is bearish.

To turn provisionally bullish, I would need to see Silver >17.50, and Gold >1400. The latter looks very unlikely before year end.

The fed look set to raise rates Sept'26th and Dec'19th. Each rate hike is inherently bearish, raising the carry costs for Gold and especially Silver.

-

Miner implications: This week saw GDX fail to hold core support, and its reflective of m/t weakness in the precious metals.

Gold weekly

Silver, weekly

Summary

A ninth consecutive net weekly decline for silver, the worse run in some years.

Gold settled net lower for the 12th week of 17. Cyclically, both metals are on the low side, and due a multi-week bounce. However, the m/t trend for both is bearish.

To turn provisionally bullish, I would need to see Silver >17.50, and Gold >1400. The latter looks very unlikely before year end.

The fed look set to raise rates Sept'26th and Dec'19th. Each rate hike is inherently bearish, raising the carry costs for Gold and especially Silver.

-

Miner implications: This week saw GDX fail to hold core support, and its reflective of m/t weakness in the precious metals.

Friday, 27 July 2018

Third week lower for Gold

The precious metals of Gold and Silver saw net weekly declines of -$8.10 (0.6%) to $1223.00, and -$0.06 (0.3%) to

$15.49 respectively. Near term outlook offers further downside, not least if the USD strengthens. The m/t

outlook has turned very bearish, with Silver <$16s, and Gold having failed to hold the Dec'2017 low.

Gold weekly

Silver weekly

Summary

Suffice to add... a third week lower for gold, whilst silver fell for a seventh consecutive week.

It can be argued that both metals are cyclically on the low side, and due a multi-week bounce, but there is ZERO sign of a s/t floor/turn.

Further, the recent breaks of key m/t support bode for far lower levels. With Gold <1230, old legacy target of 900/875 is valid. That would likely equate to Silver $10 or so. I recognise that is a very long way down. I would argue though, unless Gold >1400, the gold bugs have nothing to get confident about.

Gold weekly

Silver weekly

Summary

Suffice to add... a third week lower for gold, whilst silver fell for a seventh consecutive week.

It can be argued that both metals are cyclically on the low side, and due a multi-week bounce, but there is ZERO sign of a s/t floor/turn.

Further, the recent breaks of key m/t support bode for far lower levels. With Gold <1230, old legacy target of 900/875 is valid. That would likely equate to Silver $10 or so. I recognise that is a very long way down. I would argue though, unless Gold >1400, the gold bugs have nothing to get confident about.

Friday, 13 July 2018

Gold continues to fall

The precious metals of Gold and Silver saw net weekly declines of -$14.60 (1.2%) to $1241.20, and -$0.25 (1.6%) to

$15.81 respectively. Near term outlook offers further downside, not least if the USD climbs to the DXY 96s or higher. The m/t

outlook is turning very bearish, with Silver <$16s, with Gold having failed to hold the Dec'2017 low.

Gold weekly

Silver weekly

Summary

The precious metals are turning even uglier.

-Gold cooled for the 4th week of 5, whilst Silver declined for a fifth consecutive week.

-Both Gold and Silver are under the rising trend from the key Dec'2015 lows.

-Silver's weekly close <16.00 is decisively bearish.

-Gold broke below the Dec'2017 low of $1238.30

--

Gold, Silver, Copper, monthly, 10yr

Copper is leading the way lower, gold is following closely, with silver also leaning weak. Its pretty much outright ugly, with no sign of a s/t floor.

Bearish implications for the related mining stocks, even the upper tier names such as Newmont Mining (NEM) and Barrick Gold (ABX). The cautious will leave the sector well alone.

Gold weekly

Silver weekly

Summary

The precious metals are turning even uglier.

-Gold cooled for the 4th week of 5, whilst Silver declined for a fifth consecutive week.

-Both Gold and Silver are under the rising trend from the key Dec'2015 lows.

-Silver's weekly close <16.00 is decisively bearish.

-Gold broke below the Dec'2017 low of $1238.30

--

Gold, Silver, Copper, monthly, 10yr

Copper is leading the way lower, gold is following closely, with silver also leaning weak. Its pretty much outright ugly, with no sign of a s/t floor.

Bearish implications for the related mining stocks, even the upper tier names such as Newmont Mining (NEM) and Barrick Gold (ABX). The cautious will leave the sector well alone.

Friday, 6 July 2018

Gold breaks a new low

The precious metals of Gold and Silver saw net weekly changes of +$1.30 (0.1%) to $1255.80, and -$0.13 (0.8%) to

$16.07 respectively. Near term outlook offers further downside, not least if the USD climbs to the DXY 96s or higher. The m/t

outlook would

turn decisively bearish if Gold <$1230 and Silver <$16s.

Gold weekly

Silver weekly

Summary

Suffice to add, it was not a great week for the precious metals. Whilst gold did settle net higher for the week, it was a fractional gain. Further, gold came within 50 cents of the Dec'2017 low of $1238.30.

Cyclically, neither metal are offering any kind of clear floor/turn. Price structure in Silver was arguably a giant wedge/triangle.. and that clearly broke to the downside a few weeks ago.

As ever, any further strength in the USD will be a downward pressure on commodities, especially gold and silver.

Gold weekly

Silver weekly

Summary

Suffice to add, it was not a great week for the precious metals. Whilst gold did settle net higher for the week, it was a fractional gain. Further, gold came within 50 cents of the Dec'2017 low of $1238.30.

Cyclically, neither metal are offering any kind of clear floor/turn. Price structure in Silver was arguably a giant wedge/triangle.. and that clearly broke to the downside a few weeks ago.

As ever, any further strength in the USD will be a downward pressure on commodities, especially gold and silver.

Friday, 29 June 2018

Gold falls for a third month

The precious metals of Gold and Silver cooled for a third week, which resulted in net June declines of -$50.20 (3.8%) to $1254.50, and -$0.26 (1.6%) to

$16.20 respectively. Near term outlook offers further downside, not least if the USD climbs to the DXY 96s or higher. The m/t

outlook would

turn decisively bearish if Gold <$1238 and Silver <$16s.

Gold monthly1b

Silver monthly1b

Summary

Gold settled net lower for a third consecutive month, breaking a new low for the year of $1246.90. The Dec'2017 low of $1238 is critical. Any price action <1230 would be decisive, and bring back on the menu, legacy target of 900/875.

Silver saw June weakness, but price action is far more choppy than gold.July is going to be a very important month, especially for Gold.

Gold monthly1b

Silver monthly1b

Summary

Gold settled net lower for a third consecutive month, breaking a new low for the year of $1246.90. The Dec'2017 low of $1238 is critical. Any price action <1230 would be decisive, and bring back on the menu, legacy target of 900/875.

Silver saw June weakness, but price action is far more choppy than gold.July is going to be a very important month, especially for Gold.

Friday, 22 June 2018

Metals cool for a second week

The precious metals of Gold and Silver cooled for a second consecutive week, -$7.80 (0.6%) to $1270.70, and -$0.02 (0.1%) to

$16.46 respectively. Near term outlook offers further downside, not least if the USD climbs to the DXY 96s or higher. The m/t

outlook would

turn decisively bearish if Gold <$1238 and Silver <$16s.

Gold weekly

Silver weekly

Summary

Gold is very close to the critical Dec'2017 low of $1238. If that is taken out, it would also result in rising trend - from Dec'2015, being broken. If that happens, legacy target of 900/875 will be brought back on the menu. For the moment, its a very borderline situation.

Silver has broken rising trend, that stretches back to July 2017. Things would turn very bearish with any weekly closes <16.00.

It could be argued that price action is still broad chop/floor building, not least whilst the USD has seen distinct strength since the February low of DXY 88.15 to 95.22.

Gold weekly

Silver weekly

Summary

Gold is very close to the critical Dec'2017 low of $1238. If that is taken out, it would also result in rising trend - from Dec'2015, being broken. If that happens, legacy target of 900/875 will be brought back on the menu. For the moment, its a very borderline situation.

Silver has broken rising trend, that stretches back to July 2017. Things would turn very bearish with any weekly closes <16.00.

It could be argued that price action is still broad chop/floor building, not least whilst the USD has seen distinct strength since the February low of DXY 88.15 to 95.22.

Friday, 15 June 2018

Bearish break for gold

The precious metals of Gold and Silver saw net weekly declines, -$24.20 (1.9%) to $1278.50, and -$0.26 (1.6%) to

$16.48 respectively. Near term outlook offers further downside, not least if the USD climbs to the DXY 95s or higher. The m/t

outlook would

turn decisively bearish if Gold <$1238 and Silver <$16s.

Gold weekly

Silver weekly

Summary

The week ended on a very bearish note for the precious metals, with sig' net weekly declines. Gold saw a clear break of rising trend that stretches back to the Dec'2016 low. Last line of defense for the gold bugs is the Dec'2017 low of $1238. Any price action <1230 would break core rising trend from Dec'2015. If that occurred, it would open the door to legacy price target of 900/875

Silver saw a failed rally, cooling from $17.35, to settle at $16.48. The weekly candle is very spiky on the upper end, and bodes s/t bearish. Rising trend from July 2017 will be around $16.40 next week, and looks very vulnerable. Any price action <$16.00 would be very bearish.

--

To be clear, s/t bearish, not least with this week's bearish break in Gold. Any further strength in the USD would really pressure gold toward the key $1238 low.

Gold weekly

Silver weekly

Summary

The week ended on a very bearish note for the precious metals, with sig' net weekly declines. Gold saw a clear break of rising trend that stretches back to the Dec'2016 low. Last line of defense for the gold bugs is the Dec'2017 low of $1238. Any price action <1230 would break core rising trend from Dec'2015. If that occurred, it would open the door to legacy price target of 900/875

Silver saw a failed rally, cooling from $17.35, to settle at $16.48. The weekly candle is very spiky on the upper end, and bodes s/t bearish. Rising trend from July 2017 will be around $16.40 next week, and looks very vulnerable. Any price action <$16.00 would be very bearish.

--

To be clear, s/t bearish, not least with this week's bearish break in Gold. Any further strength in the USD would really pressure gold toward the key $1238 low.

Friday, 25 May 2018

Gold bouncing from rising trend

The precious metals of Gold and Silver saw net weekly gains, +$12.30 (1.0%) to $1303.70, and +$0.09 (0.5%) to

$16.55 respectively. Near term outlook offers further upside. The m/t

outlook will only

turn decisively bullish with Gold >$1400 and Silver >$18s.

Gold weekly

Silver weekly

Summary

Suffice to add, this weekly gain in gold was pretty important, and negates the s/t threat that the Dec'2017 low of $1238 might be tested. Instead, s/t outlook is bullish into early June. The next rate hike (June 13th) will be a reminder though that rates are still being regularly raised. Higher rates are inherently bearish for gold.

Things will only turn decisively bullish if Gold can break and hold the $1400 threshold. Arguably, Silver just needs the $18s.

Gold weekly

Silver weekly

Summary

Suffice to add, this weekly gain in gold was pretty important, and negates the s/t threat that the Dec'2017 low of $1238 might be tested. Instead, s/t outlook is bullish into early June. The next rate hike (June 13th) will be a reminder though that rates are still being regularly raised. Higher rates are inherently bearish for gold.

Things will only turn decisively bullish if Gold can break and hold the $1400 threshold. Arguably, Silver just needs the $18s.

Friday, 18 May 2018

Bearish metals

The precious metals of Gold and Silver saw net weekly declines, -$29.40 (2.2%) to $1291.30, and -$0.30 (1.8%) to

$16.45 respectively. Near term outlook is highly uncertain, and will be greatly dependent upon the USD and bond yields.

Gold weekly

Silver weekly

Summary

Suffice to add, gold remains stronger than silver, but both metals are lagging the broader commodity complex.

Ongoing s/t strength in the USD and higher bond yields is really keeping the downward pressure on gold, and to a slightly less degree... silver.

Technically, gold and silver both avoided a weekly close under key rising trend. The next few weeks are going to be rather important!

Gold weekly

Silver weekly

Summary

Suffice to add, gold remains stronger than silver, but both metals are lagging the broader commodity complex.

Ongoing s/t strength in the USD and higher bond yields is really keeping the downward pressure on gold, and to a slightly less degree... silver.

Technically, gold and silver both avoided a weekly close under key rising trend. The next few weeks are going to be rather important!

Friday, 11 May 2018

Weekly gains

The precious metals of Gold and Silver saw net weekly gains, +$6.00 (0.5%) to $1320.70, and +$0.23 (1.4%) to

$16.75 respectively. Near term outlook offers further upside. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Gold remains broadly stronger than Silver, but both metals are m/t choppy since early 2017, especially relative to the broader commodity complex.

Partly based on m/t bullish trends in copper and oil, I'm still leaning toward an eventual bullish breakout in Gold. For now, there is ZERO sign of that.

Gold weekly

Silver weekly

Summary

Gold remains broadly stronger than Silver, but both metals are m/t choppy since early 2017, especially relative to the broader commodity complex.

Partly based on m/t bullish trends in copper and oil, I'm still leaning toward an eventual bullish breakout in Gold. For now, there is ZERO sign of that.

Monday, 30 April 2018

Broadly churning

The precious metals of Gold and Silver were moderately mixed in March, settling -$8.10 (0.6%) to $1319.20, and +$0.13 (0.8%) to

$16.40 respectively. Near term outlook offers further chop. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold monthly

Silver monthly

Summary

There is little to add, as the precious metals continue to broadly churn since early 2017. Gold remains notably stronger than Silver.

Best guess: an eventual upside break in Gold... with Silver to follow, as partly based on m/t bullish trends in WTIC and copper. For the moment though, gold is showing zero sign* of a breakout, partly pressured by a recently strengthening USD.

*implications for the related miners.

Gold monthly

Silver monthly

Summary

There is little to add, as the precious metals continue to broadly churn since early 2017. Gold remains notably stronger than Silver.

Best guess: an eventual upside break in Gold... with Silver to follow, as partly based on m/t bullish trends in WTIC and copper. For the moment though, gold is showing zero sign* of a breakout, partly pressured by a recently strengthening USD.

*implications for the related miners.

Friday, 20 April 2018

Mixed metals

The precious metals of Gold and Silver were rather mixed this week, settling -$9.60 (0.7%) to $1338.30, and +$0.50 (3.0%) to

$17.16 respectively. Near term outlook offers broader upside. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, the metals were rather mixed this week. Unusually, Silver is outperforming gold, although across the last year or so, its still massively lagging.

--

Copper, Gold, Silver, 10yr, monthly

The trio of metals do broadly trade together across the years. Since late 2015, Copper and Gold are performing far better than Silver. This past week's sig' gain in Silver could well be the start of a major bullish run. Keep in mind, the broader commodity complex is climbing. I'd refer anyone to the following CRB chart...

Soft target for the CRB remains the 220/30 zone. If correct, bullish implications for the metals (and related mining stocks), at least to some degree.

Gold weekly

Silver weekly

Summary

Suffice to add, the metals were rather mixed this week. Unusually, Silver is outperforming gold, although across the last year or so, its still massively lagging.

--

Copper, Gold, Silver, 10yr, monthly

The trio of metals do broadly trade together across the years. Since late 2015, Copper and Gold are performing far better than Silver. This past week's sig' gain in Silver could well be the start of a major bullish run. Keep in mind, the broader commodity complex is climbing. I'd refer anyone to the following CRB chart...

Soft target for the CRB remains the 220/30 zone. If correct, bullish implications for the metals (and related mining stocks), at least to some degree.

Thursday, 29 March 2018

A mixed month for the metals

The precious metals of Gold and Silver were moderately mixed in March, settling +$9.40 (0.7%) to $1327.30, and -$0.14 (0.8%) to

$16.27 respectively. Near term outlook offers further chop. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold monthly

Silver monthly

Summary

Suffice to add, Gold remains notably stronger than Silver. Broadly, both metals have been churning since early 2017. Things only turn decisively bullish if Gold >$1400s and Silver >$22s.

Gold monthly

Silver monthly

Summary

Suffice to add, Gold remains notably stronger than Silver. Broadly, both metals have been churning since early 2017. Things only turn decisively bullish if Gold >$1400s and Silver >$22s.

Friday, 23 March 2018

Big gains for the metals

The precious metals of Gold and Silver saw broad gains, settling +$37.60 (2.9%) to $1349.90, and +$0.31 (1.9%) to

$16.58 respectively. Near term outlook offers further upside. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold remains notably stronger than Silver

Gold and Silver have been broadly choppy since early 2017. Things would turn decisively bullish with Gold >$1400, and Silver >$22s.

If the metals do proceed higher across the spring/early summer, it will bode very well for the related gold/silver mining stocks.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold remains notably stronger than Silver

Gold and Silver have been broadly choppy since early 2017. Things would turn decisively bullish with Gold >$1400, and Silver >$22s.

If the metals do proceed higher across the spring/early summer, it will bode very well for the related gold/silver mining stocks.

Friday, 16 March 2018

Weak metals

The precious metals of Gold and Silver were broadly weak, with net weekly declines of -$11.70 (0.9%) to $1312.30, and -$0.34 (2.0%) to

$16.27 respectively. Near term outlook offers further chop. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold remains notably more resilient that Silver. Both metals are broadly choppy.

Silver is testing core rising trend from summer 2017. Another sig' weekly decline would bode bearish, but my guess is that a rebound in the metals is due, as the fed are set to raise rates.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold remains notably more resilient that Silver. Both metals are broadly choppy.

Silver is testing core rising trend from summer 2017. Another sig' weekly decline would bode bearish, but my guess is that a rebound in the metals is due, as the fed are set to raise rates.

Friday, 9 March 2018

Choppy metals

The precious metals of Gold and Silver saw a week

of chop, with net weekly gains of +$0.60 (0.1%) to $1324.00, and +$0.14 (0.9%) to

$16.61 respectively. Near term outlook offers further chop. The m/t

outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold remains broadly stronger than Silver.

Both metals have been broadly choppy since early 2017.

Partly based on m/t bullish trends in copper and oil, I'm leaning to eventual bullish upward breaks in gold, with silver following. If correct, bullish implications for the related mining stocks.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold remains broadly stronger than Silver.

Both metals have been broadly choppy since early 2017.

Partly based on m/t bullish trends in copper and oil, I'm leaning to eventual bullish upward breaks in gold, with silver following. If correct, bullish implications for the related mining stocks.

Friday, 2 March 2018

Gold and Silver cooling

The precious metals of Gold and Silver saw a second consecutive week of declines, -$6.90 (0.5%) to $1323.40, and -$0.02 (0.1%) to

$16.47 respectively. Near term outlook offers a little chop. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add...

-Gold is still broadly stronger than Silver.

-Silver notably tested m/t rising trend this week

I'm still leaning on an eventual upward break, the key thresholds are gold >1400 and Silver >22.

Gold weekly

Silver weekly

Summary

Suffice to add...

-Gold is still broadly stronger than Silver.

-Silver notably tested m/t rising trend this week

I'm still leaning on an eventual upward break, the key thresholds are gold >1400 and Silver >22.

Friday, 23 February 2018

Precious metals cooling

The precious metals of Gold and Silver saw significant net weekly

declines of -$25.90 (1.9%) to $1330.30, and -$0.23 (1.4%) to

$16.48 respectively. Near term outlook offers a little chop. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold continues to remain far stronger than Silver. Both metals are holding the m/t upward trend from summer 2017.

The m/t outlook would turn decisively bullish if Gold >$1400 and Silver >$22s. Based on m/t price action in copper and WTIC, I continue to lean to the view that gold and silver will eventually catchup.

--

Copper, Gold, Silver, monthly'10yr

The trio of metals trade broadly together across the years, and with copper m/t bullish, both gold and silver should follow.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold continues to remain far stronger than Silver. Both metals are holding the m/t upward trend from summer 2017.

The m/t outlook would turn decisively bullish if Gold >$1400 and Silver >$22s. Based on m/t price action in copper and WTIC, I continue to lean to the view that gold and silver will eventually catchup.

--

Copper, Gold, Silver, monthly'10yr

The trio of metals trade broadly together across the years, and with copper m/t bullish, both gold and silver should follow.

Friday, 16 February 2018

Gold and Silver climbing

The precious metals of Gold and Silver saw significant net weekly gains of $40.50 (3.1%) to $1356.20, and $0.57 (3.5%) to

$16.71 respectively. Near term outlook offers further upside, not least if the USD fails to hold the key DXY 88s. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, a bullish week for the precious metals of gold and silver. Gold remains notably stronger than silver.

Best guess: a spring/summer upside break, with Gold >$1400s, and Silver eventually following >$22s.

Yours truly believes 'Mr inflation is out there'.

Gold weekly

Silver weekly

Summary

Suffice to add, a bullish week for the precious metals of gold and silver. Gold remains notably stronger than silver.

Best guess: a spring/summer upside break, with Gold >$1400s, and Silver eventually following >$22s.

Yours truly believes 'Mr inflation is out there'.

Subscribe to:

Comments (Atom)