The precious metals of Gold and Silver saw significant net weekly

declines of -$25.90 (1.9%) to $1330.30, and -$0.23 (1.4%) to

$16.48 respectively. Near term outlook offers a little chop. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, Gold continues to remain far stronger than Silver. Both metals are holding the m/t upward trend from summer 2017.

The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s. Based on m/t price action in copper and WTIC, I continue to lean to the view that gold and silver will eventually catchup.

--

Copper, Gold, Silver, monthly'10yr

The trio of metals trade broadly together across the years, and with copper m/t bullish, both gold and silver should follow.

Friday, 23 February 2018

Friday, 16 February 2018

Gold and Silver climbing

The precious metals of Gold and Silver saw significant net weekly gains of $40.50 (3.1%) to $1356.20, and $0.57 (3.5%) to

$16.71 respectively. Near term outlook offers further upside, not least if the USD fails to hold the key DXY 88s. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, a bullish week for the precious metals of gold and silver. Gold remains notably stronger than silver.

Best guess: a spring/summer upside break, with Gold >$1400s, and Silver eventually following >$22s.

Yours truly believes 'Mr inflation is out there'.

Gold weekly

Silver weekly

Summary

Suffice to add, a bullish week for the precious metals of gold and silver. Gold remains notably stronger than silver.

Best guess: a spring/summer upside break, with Gold >$1400s, and Silver eventually following >$22s.

Yours truly believes 'Mr inflation is out there'.

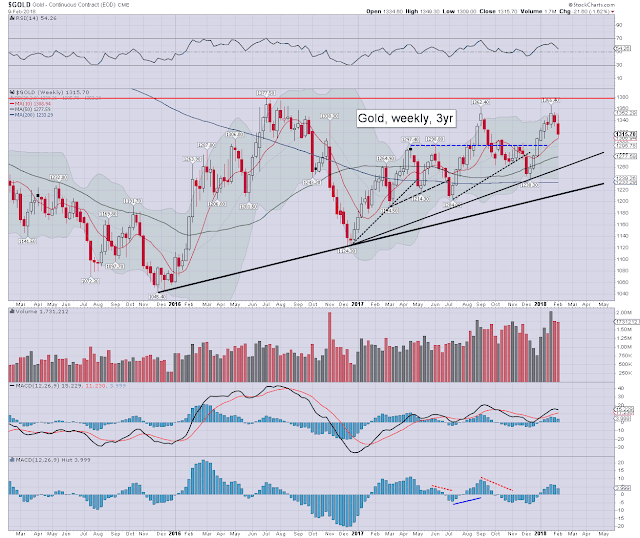

Friday, 9 February 2018

A second week lower

The precious metals of Gold and Silver saw a second consecutive week of cooling, with

net weekly declines of -$21.60 (1.6%) to $1315.70, and -$0.57 (3.4%) to

$16.14 respectively. Near term outlook threatens a bounce, not least if the USD cools. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, a second week lower, but broadly, price action has been choppy for over a year. Things only become decisively bullish if Gold >$1400s and Silver >$22s.

Keep in mind Copper...

... which is still holding a m/t bullish trend. Gold, Silver, and Copper do broadly trade together across the years. Unless copper loses the m/t trend, I still expect gold/silver to eventually follow upward.

Gold weekly

Silver weekly

Summary

Suffice to add, a second week lower, but broadly, price action has been choppy for over a year. Things only become decisively bullish if Gold >$1400s and Silver >$22s.

Keep in mind Copper...

... which is still holding a m/t bullish trend. Gold, Silver, and Copper do broadly trade together across the years. Unless copper loses the m/t trend, I still expect gold/silver to eventually follow upward.

Friday, 2 February 2018

A cooling week

The precious metals of Gold and Silver saw a week of cooling, with

net weekly declines of -$14.80 (1.1%) to $1337.30, and -$0.73 (4.2%) to

$16.71 respectively. Near term outlook is choppy. The m/t outlook would

turn decisively bullish if Gold >$1400 and Silver >$22s.

Gold weekly

Silver weekly

Summary

Suffice to add, an arguably 'sporadic' week of cooling, with the metals somewhat pressured as the USD is trying to bounce from last week's low in the DXY 88.20s.

Broadly... price action has been choppy since early 2017. Things turn decisive if Gold >$1400 and Silver $22s.

--

Gold weekly

Silver weekly

Summary

Suffice to add, an arguably 'sporadic' week of cooling, with the metals somewhat pressured as the USD is trying to bounce from last week's low in the DXY 88.20s.

Broadly... price action has been choppy since early 2017. Things turn decisive if Gold >$1400 and Silver $22s.

--

Subscribe to:

Comments (Atom)