The precious metals of Gold and Silver saw net January changes of -$44.80 (2.4%) to

$1850.30, and +$0.50

(1.9%) to

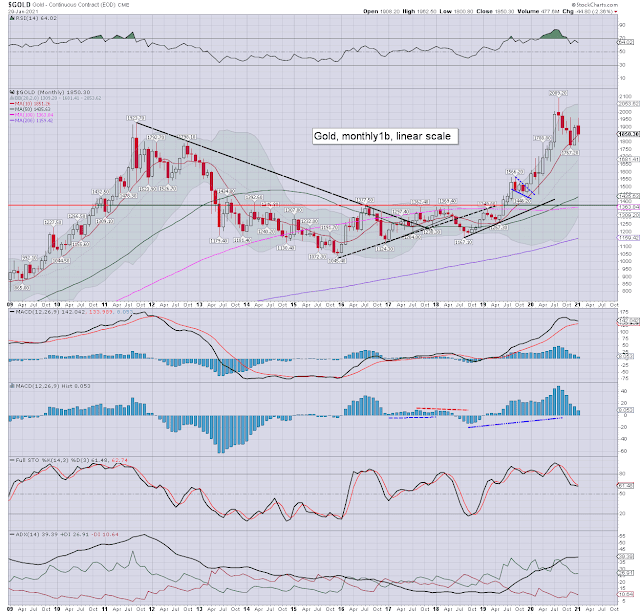

$26.91 respectively. The mid term trend in gold

and silver remains bullish, with both metals sporting price structure of a multi-month bull flag.

Gold, monthly1b

Silver, monthly1b

Summary

Gold: Gold printed $1962.50, but cooled back to settle the month $1850.30, just fractionally below the monthly 10MA. For now, price structure is still a valid bull flag. The July 2020 break above psy' $2K offers a grander

target

of the 2400/500 zone, which appears realistic as early as late summer.

Silver: A second consecutive net monthly gain, with a January high of $28.10. Soft target is the Aug'2020 high of $29.92. Any price action >psy'30 would be decisive, and offer a fast run to the 35/37 zone, which appears realistic as early as April/May.

--

The Gold-Silver ratio stands at 68.75. Grand target are the 32s, which looks feasible before end 2021.