The precious metals of Gold and Silver saw net August declines of -$43.30 (2.2%) to

$1965.90, and -$0.16 (0.6%) to

$24.81 respectively. Monthly momentum remains positive, but the three concerns should be renewed dollar upside, higher bond yields, and a weak equity market.

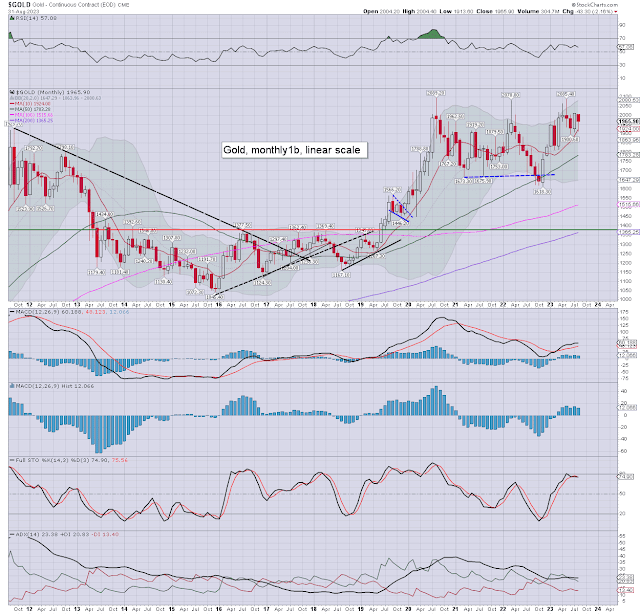

Gold, monthly1b

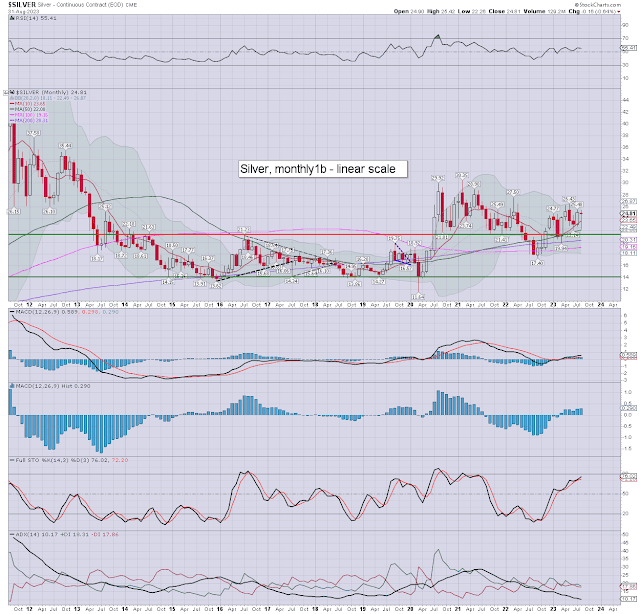

Silver, monthly1b

Summary

Gold: cooling to $1913.60, but recovering to settle in the $1965s.

Price momentum was positive for a fifth month. I'd note first major support of the key 10MA has climbed to the $1924s.

Next upside resistance is the Aug'2020 historic high of the $2089s. Any price action >2100, would offer the 2400/2500 zone.

Any

renewed upside in the dollar won't help, nor would any further rate

hikes. Indeed, considering the ongoing rate hike cycle, gold is

performing better than it might seem.

-

Silver: printing $22.26, if recovering to settle at $24.81. Momentum was net positive for a sixth month. I would note the monthly

10MA at $23.65, which silver settled above.

A key threat to silver, will be if the main

market sees renewed downside. A further downward pressure will be

if the dollar strengthens.

Of the two metals, I favour Gold, especially for a potential geo-political 'fear bid', not least via Ukraine/Russia or China/Taiwan. I'd accept silver has massively more upside potential than gold, but many have been saying that since the $49s of 2011.

For more of the same...

For details > https://www.tradingsunset.com