The precious metals of Gold and Silver saw net June declines of -$6.20 (0.3%) to $2339.60, and -$0.88 (2.9%) to $29.56 respectively.

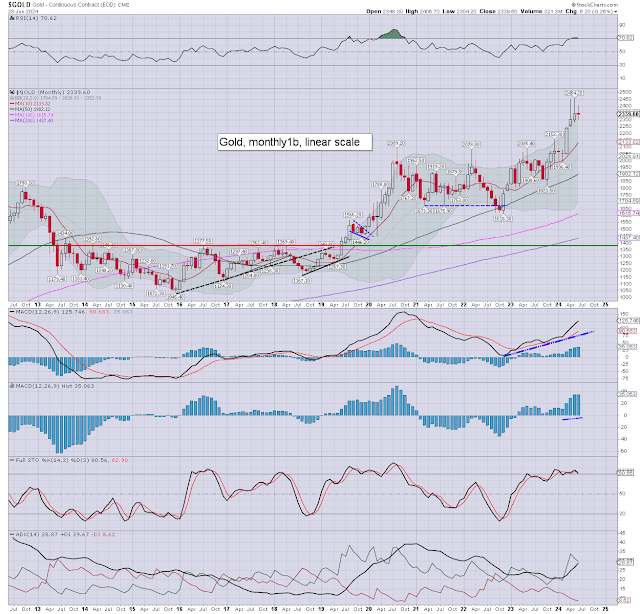

Gold, monthly

Silver, monthly

Summary

Gold: a June high of $2406, if cooling back to the $2339s. An eighth consecutive monthly close above psy' $2K. Price momentum is flat-lining on the high side. I would note the monthly 10MA at $2133, which was settled above, as the m/t trend is bullish.

Having already reached the 2400/2500 zone, 3K appears realistic before year end.

--

Silver: a June high of $31.67, if cooling back to $29.56. Momentum continued to tick upward, settling moderately positive.

I would note the monthly 10MA at $25.28, which was settled above.

The monthly settlement under psy' $30.00 isn't a great sign. However it could be argued we've just seen a multi-week retrace of the wave from 21>32.

Next resistance

are the $35s, last printed in Oct'2012. Any price action >36.00 would

open the door to the 49/psy'50 zone.

The problem will be if the main equity

market sees any cooling this summer/fall. Further downward pressures would be

if the dollar strengthens, or if bond yields climb.

-

The Gold - Silver ratio stands at 79.15, which is certainly still on the high side. I have to expect the 32s, but that could easily be at least 2-3 years away.

-

The USD saw a net June gain of +92bps to DXY 105.54. All such dollar strength is an inherent downward pressure on ALL asset classes, not least gold and silver. It is the case though that the dollar and gold can sometimes climb and fall together.

-

The Gold - Bitcoin ratio has cooled to 26.04.

Things would turn 'interesting' if >34, but there is no sign of that.

*As ever, ratios are to be treated with caution, as both assets can rise or fall together, whilst the ratio remains the same.

**Ohh, and for 'physical' holdings, I would absolutely favour silver, which has much higher percentage gain potential.

--

For more of the same...

Summer subscription offers > https://www.tradingsunset.com