The precious metals of Gold and Silver saw net August gains of +$54.60 (2.2%) to $2527.60, and +$0.20 (0.7%) to $29.14 respectively.

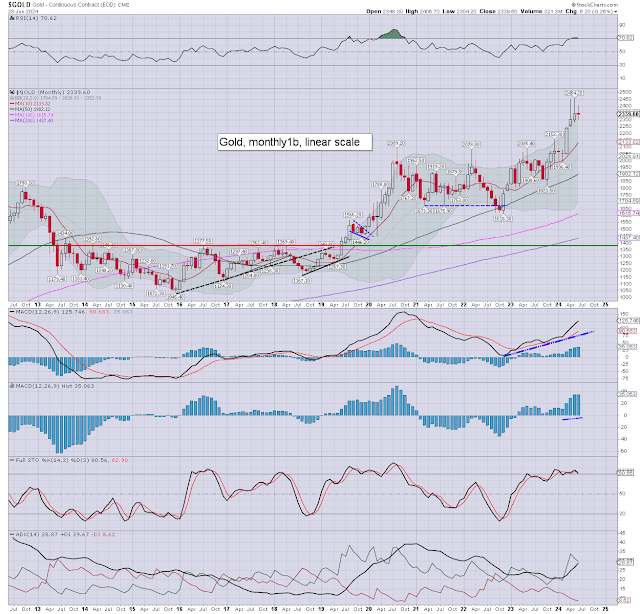

Gold, monthly1b

Silver, monthly1b

Summary

Gold: A new historic high of $2570.40, if cooling back to settle in the $2527s. A tenth consecutive monthly close above psy' $2K. Price momentum ticked upward, and is on the very high side. I would note the monthly 10MA at $2247, which was settled above, as the m/t trend is bullish.

Having already reached the 2400/2500 resistance zone, 3K appears realistic before year end.

--

Silver: an August low of $26.50, but recovering to $29.14. Momentum ticked a little lower, if still on the moderately high side.

I would note the monthly 10MA at $26.55, which was settled above.

The third consecutive monthly settlement under psy' $30.00 isn't a great sign for Sept-Oct'.

The problem will be if the equity market sees any cooling this fall. Further downward pressures would be if the dollar strengthens, or if bond yields rebound.

--

The gold-silver ratio stands at 86.73, which is on the

high side. I hold to the view that silver will greatly outperform gold,

if on a 5-10 year basis.

-

The gold-bitcoin ratio fell to 23.36.

As ever, ratios are to be treated with caution.

--

For more of the same...

Subscribe > https://www.tradingsunset.com