The precious metals of Gold and Silver saw net June declines of

-$52.70 (2.7%) to

$1929.40, and -$0.57

(2.4%) to

$23.02 respectively. Monthly momentum remains positive, but the two

concerns should be renewed dollar upside and higher bond yields.

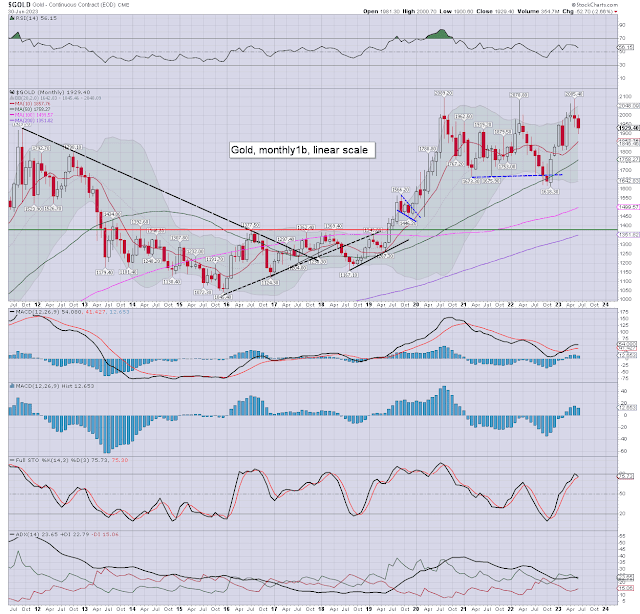

Gold, monthly1b

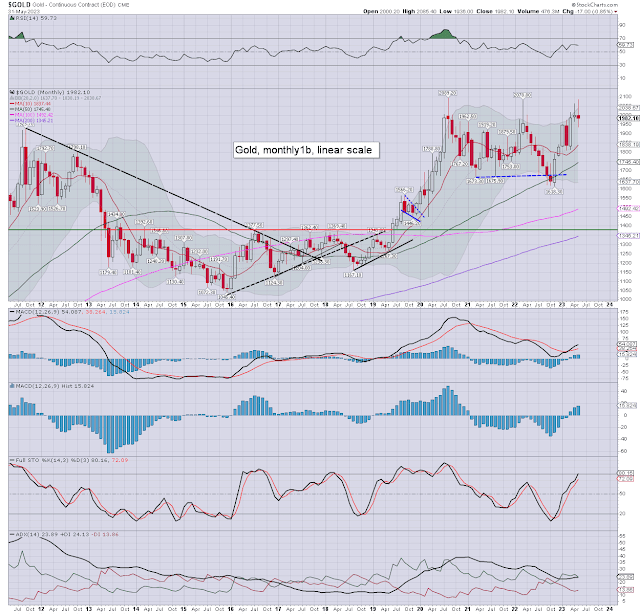

Silver, monthly1b

Summary

Gold: cooling to $1900.60, and recovering to settle in the $1929s. Price momentum was positive for a fourth month. The June candle offers a lower high, and a lower low. I'd note first major support of the key 10MA in the $1857s.

Next upside resistance is the Aug'2020 historic high of the $2089s. Any price action >2100, would offer the 2400/2500 zone.

Any renewed upside in the dollar won't help, nor would any further rate hikes.

-

Silver: printing $22.14, if recovering to settle at $23.02.

Momentum was net positive for a fourth month. I would note the monthly

10MA at $22.49, which silver settled above.

A key threat to silver, will be if the main

market sees renewed downside. A further downward pressure will be

if the dollar resumes upward.

Of the two metals, I favour Gold, especially for a potential geo-political 'fear bid'. I'd accept silver has massively more upside potential than gold, but many have been saying that since the $49s of 2011.

For more of the same...

For details and the latest offers > https://www.tradingsunset.com