With the main US capital markets somewhat weak, the precious metals were similarly weak. Gold and Silver saw net weekly declines of 0.2% and 2.4% respectively. The near term trend however is still to the upside, but a few weeks stuck at these levels..could bode for renewed downside.

GLD, weekly2, rainbow

SLV, weekly2, rainbow

Summary

Suffice to say, the metals are still doing very well since the June lows. This weeks minor declines certainly do not wreck the broader upward trend..but as many recognise..there is severe resistance around current levels.

In terms of the 'rainbow' (Elder Impulse) charts, metal-bears should look for the first blue candle to appear in the coming few weeks.

If we see 3 or more blue candles by late September, it will likely mean the current rally from June was indeed a mere 'bear market rally' - much like the one of Aug-Sept' 2012.

--

Mid-term 'bearish' targets remain GLD 90s.... SLV 12/10

Friday, 30 August 2013

Tuesday, 27 August 2013

Metals rising on classic war fears

With equities significantly lower, the metals (along with Oil) rose on traditional war fears. Gold and Silver closed with reasonable gains of 1.0% and 0.5% respectively. Broad trend remains to the upside, despite a USD that looks to have floored.

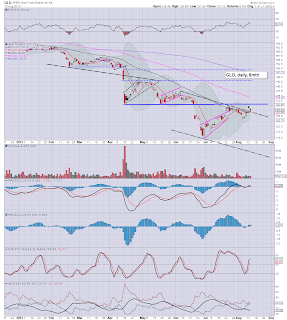

GLD, daily

SLV, daily

Summary

Little to add, aside that the metals look set for a few more weeks higher..before the bigger trend resumes to the downside.

GLD, daily

SLV, daily

Summary

Little to add, aside that the metals look set for a few more weeks higher..before the bigger trend resumes to the downside.

Monday, 26 August 2013

Precious Metals rise on war talk

After moderate weakness for much of the day, the precious metals battled back higher in the closing hour, as Syria war-talk spooked the US markets. Gold and Silver closed with gains of 0.4% and 1.3% respectively. Near term trend remains clearly to the upside.

GLD, daily

SLV, daily

Summary

The bullish trend continues for the metals, even on a day when equities closed somewhat weak.

Near term targets remain in the GLD 142/45, with SLV 25/26.

--

Mid-term targets, GLD 90s, with SLV 12/10.

However, those latter targets are dependent upon no consecutive monthly closes of spot Gold in the $1500s.

GLD, daily

SLV, daily

Summary

The bullish trend continues for the metals, even on a day when equities closed somewhat weak.

Near term targets remain in the GLD 142/45, with SLV 25/26.

--

Mid-term targets, GLD 90s, with SLV 12/10.

However, those latter targets are dependent upon no consecutive monthly closes of spot Gold in the $1500s.

Friday, 23 August 2013

Metals continuing to gain

Whilst equities saw weakness for much of the week, the precious metals saw further gains. Gold and Silver closed with net weekly gains of 1.7% and 3.6% respectively. Near term trend looks strong, with a further 5-7% upside into September.

GLD,weekly

SLV, weekly

Summary

*I've added a fib-retrace, assuming the recent down wave ran from Oct'2012, to the June 2013 lows.

Well, another pretty strong week for the metals, certainly, relative to the main US equity markets which remain weak.

---

Near term targets look to be GLD 142/145, and SLV 24/25

Despite the current recent strong gains, I'm still guessing this is merely a bounce, like Aug-October of last year.

Mid-term targets remain: GLD in the 90s..and SLV 12/10.

GLD,weekly

SLV, weekly

Summary

*I've added a fib-retrace, assuming the recent down wave ran from Oct'2012, to the June 2013 lows.

Well, another pretty strong week for the metals, certainly, relative to the main US equity markets which remain weak.

---

Near term targets look to be GLD 142/145, and SLV 24/25

Despite the current recent strong gains, I'm still guessing this is merely a bounce, like Aug-October of last year.

Mid-term targets remain: GLD in the 90s..and SLV 12/10.

Wednesday, 21 August 2013

Metals choppy on more Fed-speak

The precious metals closed moderately lower, but earlier surged after the latest FOMC minutes were released. Gold and Silver both closed around 0.25% lower. Near term trend remains bullish, with targets of GLD into the 140s, and SLV to 24/26.

GLD, daily

SLV, daily

Summary

The main US markets remain somewhat shaky, on the thought of QE being cut.

This is certainly a bigger mid/long term problem for the metals, but in the near term, metals are still comfortably climbing.

Targets look pretty clear..GLD 140s...and SLV 24/26 zone.

--

Mid-term trend remains to the downside though - especially supported on the hugely important monthly charts, with Gold in the $900s, and Silver in the 12/10.

Of course, such downside talk is heresy to the 'gold bugs'. So be it.

GLD, daily

SLV, daily

Summary

The main US markets remain somewhat shaky, on the thought of QE being cut.

This is certainly a bigger mid/long term problem for the metals, but in the near term, metals are still comfortably climbing.

Targets look pretty clear..GLD 140s...and SLV 24/26 zone.

--

Mid-term trend remains to the downside though - especially supported on the hugely important monthly charts, with Gold in the $900s, and Silver in the 12/10.

Of course, such downside talk is heresy to the 'gold bugs'. So be it.

Friday, 16 August 2013

Powerfully bullish precious metals

Whilst equities were weak, and bond yields climbed, the precious metals were the market anomaly. Gold and Silver saw net weekly gains of 4.6% and 13.1% respectively. Near term outlook is clearly to the upside, with further gains to GLD 142/47, and SLV 25/26.

GLD, weekly2

SLV, weekly2

Summary

The precious metals were indeed the real stars of the week, and those gains were indeed very significant.

Targets - as based also on daily/monthly charts, look pretty clear...

GLD 142/47

SLV 25/26

Those significantly higher levels will probably be hit no later than the end of September, at which point, I'd expect the metals to get seriously stuck..with spot Gold just under the big psy' level of $1500.

-

Mid-term targets remain unchanged, with Gold in the $900s, and Silver in the $12/10 area.

GLD, weekly2

SLV, weekly2

Summary

The precious metals were indeed the real stars of the week, and those gains were indeed very significant.

Targets - as based also on daily/monthly charts, look pretty clear...

GLD 142/47

SLV 25/26

Those significantly higher levels will probably be hit no later than the end of September, at which point, I'd expect the metals to get seriously stuck..with spot Gold just under the big psy' level of $1500.

-

Mid-term targets remain unchanged, with Gold in the $900s, and Silver in the $12/10 area.

Thursday, 15 August 2013

Gold breaks out

With the main equity market seeing significant weakness, the metals soared. Gold and Silver closed higher by 2% and 5% respectively. Gold has now followed Silver in clearing the old broken support. Further upside looks likely into September.

GLD'daily

SLV'daily

Summary

Silver and Gold are simply continuing higher, with very significant upside viable. Whether its a result of higher bond yields, a 'flight to safety', or purely on a 'technical retracement' basis, the metals look set to rally for a few more weeks.

Targets

GLD 142/47

SLV 25/26

GLD'daily

SLV'daily

Summary

Silver and Gold are simply continuing higher, with very significant upside viable. Whether its a result of higher bond yields, a 'flight to safety', or purely on a 'technical retracement' basis, the metals look set to rally for a few more weeks.

Targets

GLD 142/47

SLV 25/26

Tuesday, 13 August 2013

Diverging precious metals

Gold and Silver are continuing to act a little unusual. Gold closed -$14, whilst Silver managed minor gains of 7 cents (0.34%). Silver is above the old broken floor, but Gold is clearly struggling to consistently build..and hold gains.

GLD, daily

SLV, daily

Summary

I find it almost irrelevant as to where the metals go in the near term. Whether the bounce is to SLV 22..or 25/26, seems largely inconsequential.

Mid-term outlook still looks clear...with GLD in the 90s, and SLV 12/10

GLD, daily

SLV, daily

Summary

I find it almost irrelevant as to where the metals go in the near term. Whether the bounce is to SLV 22..or 25/26, seems largely inconsequential.

Mid-term outlook still looks clear...with GLD in the 90s, and SLV 12/10

Monday, 12 August 2013

Metals pushing higher

Whilst equities saw minor chop, the metals jumped significantly higher at the open, and comfortably held the gains across the day. Gold and Silver climbed 1.7% and 4.3% respectively. Silver is now on the border of the old support floor, whilst Gold is still clearly below it.

GLD, daily

SLV, daily

Summary

Silver appears to be leading the way, and is highly suggestive that a short-term breakout is now underway.

The threat - and it was a serious one, of another collapse wave lower - as based on last weeks price action, is now seemingly OFF the agenda.

--

If GLD and SLV can put in a few daily closes above the old busted May/June support floor, then the targets for Sept/Oct are...

GLD 142/147

SLV 25/26

--

Despite that outlook, the mid-term targets remain unchanged, with GLD in the 90s, and SLV 12/10.

-

GLD, daily

SLV, daily

Summary

Silver appears to be leading the way, and is highly suggestive that a short-term breakout is now underway.

The threat - and it was a serious one, of another collapse wave lower - as based on last weeks price action, is now seemingly OFF the agenda.

--

If GLD and SLV can put in a few daily closes above the old busted May/June support floor, then the targets for Sept/Oct are...

GLD 142/147

SLV 25/26

--

Despite that outlook, the mid-term targets remain unchanged, with GLD in the 90s, and SLV 12/10.

-

Friday, 9 August 2013

Weekly gains for the metals

The precious metals saw further gains, with Gold and Silver closing with net weekly gains of 0.4% and 3.4% respectively. Near trend remains moderately bullish, but price formation is yet another bear flag, and considerably lower levels are expected in Sept/October

GLD, weekly, 3yr

SLV, weekly, 3yr

Summary

Interestingly, underlying MACD (blue bar histogram) cycle is now positive for both Gold and Silver, but still, the price action sure doesn't look very bullish.

Considering the even more important monthly charts, the current bear flags - which is what they very probably are, will likely be confirmed within the next few weeks..perhaps days.

Significantly lower levels for both Gold and Silver are expected.

Mid-term target remains GLD in the 90s, and SLV 12/10.

GLD, weekly, 3yr

SLV, weekly, 3yr

Summary

Interestingly, underlying MACD (blue bar histogram) cycle is now positive for both Gold and Silver, but still, the price action sure doesn't look very bullish.

Considering the even more important monthly charts, the current bear flags - which is what they very probably are, will likely be confirmed within the next few weeks..perhaps days.

Significantly lower levels for both Gold and Silver are expected.

Mid-term target remains GLD in the 90s, and SLV 12/10.

Thursday, 8 August 2013

Strong gains for the metals

Whilst equities saw just moderate gains, the precious metals soared, with Gold and Silver closing at the highs of the day, with gains of 2.2% and 4.0% respectively. Despite the strong gains, the metals remain below key resistance, and the price action is very similar to early April...which didn't end well.

GLD,daily

SLV, daily

Summary

The precious metals certainly had one of their best days since the big gap higher on Mon' July 22.

However, the metals are actually STILL below the highs of that day..from almost 3 trading weeks ago. Any of the gold bugs getting hysterical over today's gains, really needs to stare at the above charts for a good 10-20 minutes.

Big trouble...next week?

The price action of the past few weeks looks VERY similar to late March/early April, and I am getting extremely suspicious of a 2-4 day smack down, towards the end of next week.

GLD,daily

SLV, daily

Summary

The precious metals certainly had one of their best days since the big gap higher on Mon' July 22.

However, the metals are actually STILL below the highs of that day..from almost 3 trading weeks ago. Any of the gold bugs getting hysterical over today's gains, really needs to stare at the above charts for a good 10-20 minutes.

Big trouble...next week?

The price action of the past few weeks looks VERY similar to late March/early April, and I am getting extremely suspicious of a 2-4 day smack down, towards the end of next week.

Tuesday, 6 August 2013

Metals in big trouble again

The precious metals tried for over two weeks to re-take the broken support from May/June, but have failed. Gold and Silver closed lower by 1.3% and 0.9% respectively. Near term trend looks very weak, and another 2-4 day collapse wave looks viable within the next 2-3 weeks.

GLD, daily

SLV, daily

Summary

Once again, the metals have failed. What was a potentially very important bull flag, has now been arguably negated.

Gold and Silver are now rolling over again. The recent lows from mid-June look set to be taken out within the next few weeks.

--

Mid-term targets remain GLD in the 90s..and SLV 12/10.

GLD, daily

SLV, daily

Summary

Once again, the metals have failed. What was a potentially very important bull flag, has now been arguably negated.

Gold and Silver are now rolling over again. The recent lows from mid-June look set to be taken out within the next few weeks.

--

Mid-term targets remain GLD in the 90s..and SLV 12/10.

Friday, 2 August 2013

Primary trend remains down

The bounce from the June lows has done nothing to counter the primary trend for the precious metals, which remains severely to the downside. Mid-term downside targets for Gold and Silver are unchanged, in the $900s and $12/10s respectively, which could even be hit this autumn.

GLD, monthly

SLV, monthly

Summary

The Gold bugs have been calling a floor since the metals peaked in 2011. Many are now calling a key multi-month cycle floor at the June lows, but frankly, there is nothing to suggest this is the case.

From a wave-count perspective, what we have seen since June is quite possibly a sub'4 of big (blue III). If that is the case, we should see another sharp and severe drop sometime in the next month or two.

Broad outlook is for a key multi-year cycle low sometime in the next year or two.

Gold looks set a 'final flushout' under the key psy level of $1000, if not this autumn, then next year.

If Gold is back <1000, then Silver will unquestionably be smashed down to the $12/10 zone.

--

Long term outlook for the precious metals looks great, but for those seeking Gold @ 2k (and Silver >50) in the next year or two..no...that just doesn't look likely at all.

GLD, monthly

SLV, monthly

Summary

The Gold bugs have been calling a floor since the metals peaked in 2011. Many are now calling a key multi-month cycle floor at the June lows, but frankly, there is nothing to suggest this is the case.

From a wave-count perspective, what we have seen since June is quite possibly a sub'4 of big (blue III). If that is the case, we should see another sharp and severe drop sometime in the next month or two.

Broad outlook is for a key multi-year cycle low sometime in the next year or two.

Gold looks set a 'final flushout' under the key psy level of $1000, if not this autumn, then next year.

If Gold is back <1000, then Silver will unquestionably be smashed down to the $12/10 zone.

--

Long term outlook for the precious metals looks great, but for those seeking Gold @ 2k (and Silver >50) in the next year or two..no...that just doesn't look likely at all.

Thursday, 1 August 2013

Metals back on the slide

Whilst the main equity (and to some extent) the commodity market soared, the precious metals were once again weak. Gold and Silver closed lower by 1.0% and 0.8% respectively. Despite continuing QE, the metals remain weak, and a new multi-week down cycle looks viable.

GLD, daily

SLV, daily

Summary

With each passing day that the metals remain under the old broken support of May/June, it becomes increasingly unlikely that the metals are going to be able to muster any further gains in the current up wave.

Indeed, with today's decline - as also reflected in the Gold/Silver mining stocks, it would seem the metals are seeing similar price action to late March...a failed bull flag. In that instance, it was around 3 weeks..and then in mid-April..a very severe two day collapse wave.

So..are we looking at another severe drop in the tail end of August ?

The bigger weekly/monthly charts would suggest...yes.

GLD, daily

SLV, daily

Summary

With each passing day that the metals remain under the old broken support of May/June, it becomes increasingly unlikely that the metals are going to be able to muster any further gains in the current up wave.

Indeed, with today's decline - as also reflected in the Gold/Silver mining stocks, it would seem the metals are seeing similar price action to late March...a failed bull flag. In that instance, it was around 3 weeks..and then in mid-April..a very severe two day collapse wave.

So..are we looking at another severe drop in the tail end of August ?

The bigger weekly/monthly charts would suggest...yes.

Subscribe to:

Comments (Atom)