The bounce from the June lows has done nothing to counter the primary trend for the precious metals, which remains severely to the downside. Mid-term downside targets for Gold and Silver are unchanged, in the $900s and $12/10s respectively, which could even be hit this autumn.

GLD, monthly

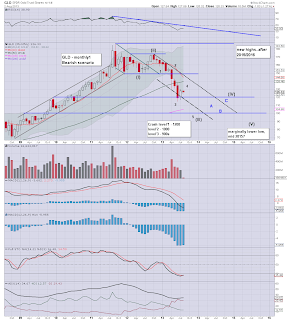

SLV, monthly

Summary

The Gold bugs have been calling a floor since the metals peaked in 2011. Many are now calling a key multi-month cycle floor at the June lows, but frankly, there is nothing to suggest this is the case.

From a wave-count perspective, what we have seen since June is quite possibly a sub'4 of big (blue III). If that is the case, we should see another sharp and severe drop sometime in the next month or two.

Broad outlook is for a key multi-year cycle low sometime in the next year or two.

Gold looks set a 'final flushout' under the key psy level of $1000, if not this autumn, then next year.

If Gold is back <1000, then Silver will unquestionably be smashed down to the $12/10 zone.

--

Long term outlook for the precious metals looks great, but for those seeking Gold @ 2k (and Silver >50) in the next year or two..no...that just doesn't look likely at all.