The precious metals of Gold and Silver saw net March gains of +$53.30 (2.8%) to

$1954.00, and +$0.77

(3.1%) to

$25.13 respectively.

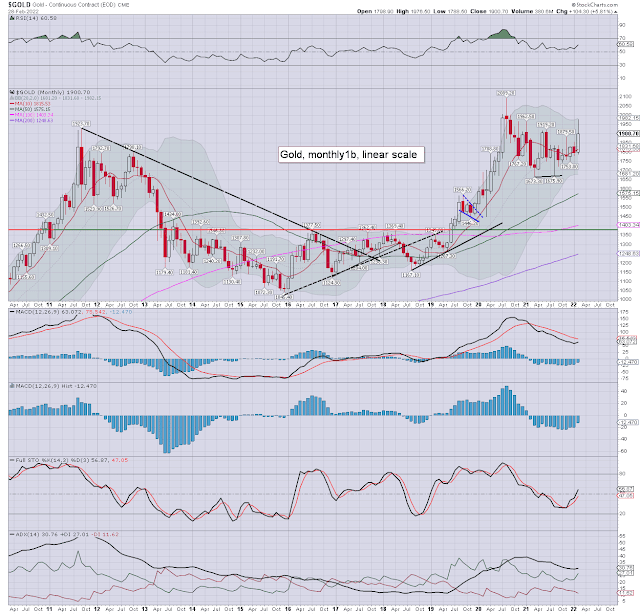

Gold, monthly1b

Silver, monthly1b

Summary

Gold: powered upward in March, largely on Russia/Ukraine, printing the $2078s, and settling in the $1954s. Price momentum is ticking upward, set to turn positive in early April. The March candle is spiky from around the Aug'2020 historic high. I would note the monthly 10MA at $1820, which was again settled above. Gold is holding some degree of 'fear bid' on Russia/Ukraine geo-political concerns.

Next target is the Aug'2020 historic high of the $2089s. A push >2100 appears probable, with a grander target of the 2400/2500 zone.

Silver: printing $27.50, but cooling back to settle at $25.13.

Momentum ticked upward, and will be prone to turning positive in May.

I would note the monthly 10MA at $23.98, which silver settled above.

Price action has been a broad chop fest since August 2020. Things

turn

decisive for the silver bulls, with a break AND hold above $25.50. The

one solace for silver bulls is that old (seven year) resistance of the

$21s, is holding as new core support.

For more of the same...

For details and the latest offers > https://www.tradingsunset.com