The precious metals of Gold and Silver saw net February gains of +$104.30 (5.8%) to

$1900.70, and +$1.97

(8.8%) to

$24.37 respectively.

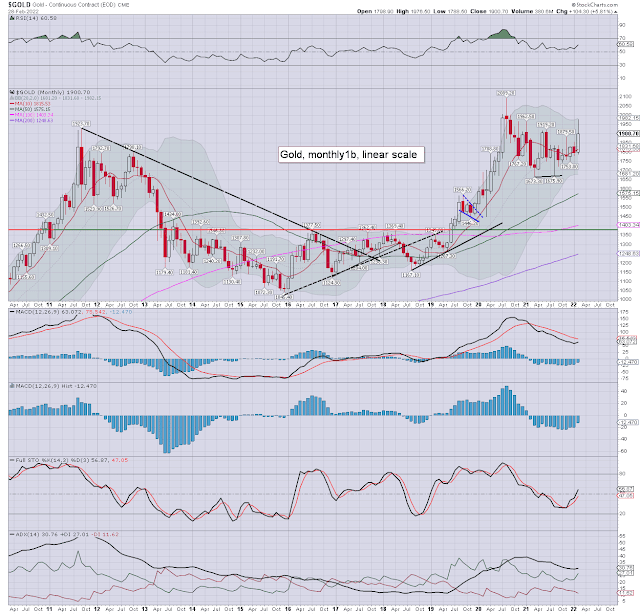

Gold, monthly1b

Silver, monthly1b

Summary

Gold: rebounded strongly in February, printing the $1976s, and settling around psy' $1900. Price momentum is ticking upward, set to turn positive within 1-2 months. The February candle is spiky from the upper bollinger. I would note the monthly 10MA at $1815, which was decisively settled above. Gold is catching some degree of 'fear bid' on Russia/Ukraine geo-political concerns.

Next (obvious) target is giant psy' 2K, and then the Aug'2020 historic high of the $2089s. A spike >2100 appears a threat within March. Grander target is the 2400/2500 zone.

Silver: printing $25.67, but cooling back to settle at $24.37. Momentum has started to tick back upward, if remaining on the moderately low

side.

I would note the monthly 10MA at $24.27, which silver settled above.

Price action has been a broad chop fest since August 2020. Things

turn

decisive for the silver bulls, with a break AND hold above $25.50. The

one solace for silver bulls is that old (seven year) resistance of the

$21s, is holding as new core support.

For more of the same...

For details and the latest offers > https://www.tradingsunset.com