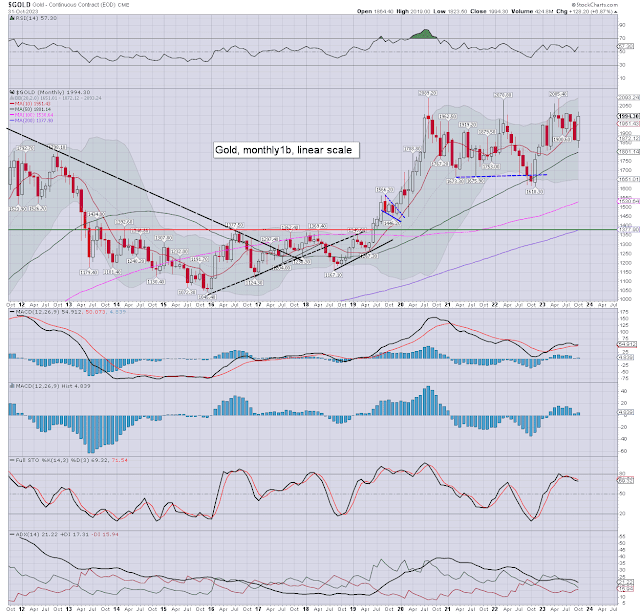

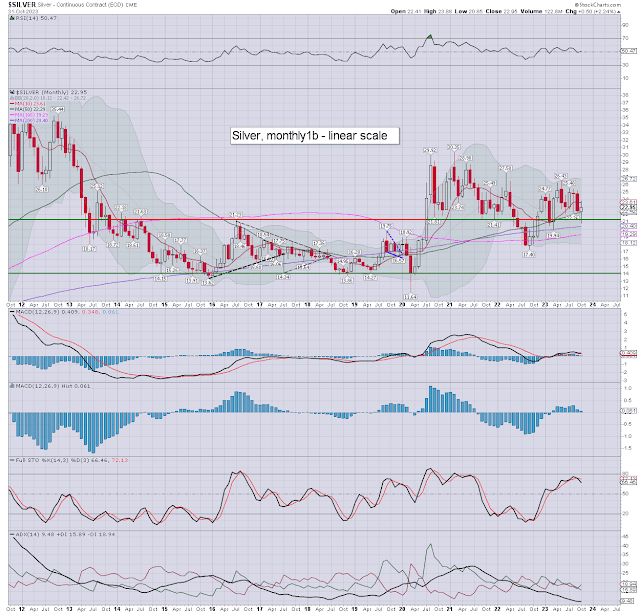

The precious metals of Gold and Silver saw net October gains of +$128.20 (6.9%) to

$1994.30, and +$0.50 (2.2%) to

$22.95 respectively. Monthly momentum remains positive, but the three

concerns should be further dollar strengthening, higher bond yields, and

a weak

equity market.

Gold, monthly1b

Silver, monthly1b

Summary

Gold: printing $2019.00, if cooling to settle in the $1994s - the highest since July. A monthly close back back the key 10MA. The October candle is bullish engulfing, and leans distinctly s/t bullish. Price

momentum was positive for a eighth month.

-

Silver: printing $20.85, but recovered upward to settle at $22.95. Another monthly close under the key

10MA. The October candle is spiky on the lower side from key price threshold of the $21s. Momentum

was net positive for a eighth month.

Key threats to silver... if the equity

market sees further downside, and dollar strengthening.

Of the two metals, I favour Gold, especially for a potential geo-political 'fear bid', not least via the middle east, Ukraine/Russia or even China/Taiwan. I'd accept silver has massively more upside potential than gold, but many have been saying that since the $49s of 2011.

For more of the same...

For details > https://www.tradingsunset.com