The precious metals of Gold and Silver saw net November declines of -$68.30 (2.5%) to $2681.00, and -$1.69 (5.1%) to $31.11 respectively.

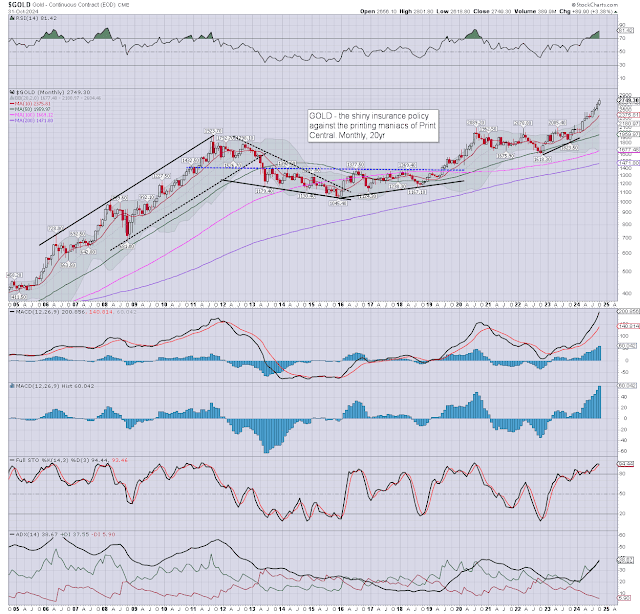

Gold, monthly20

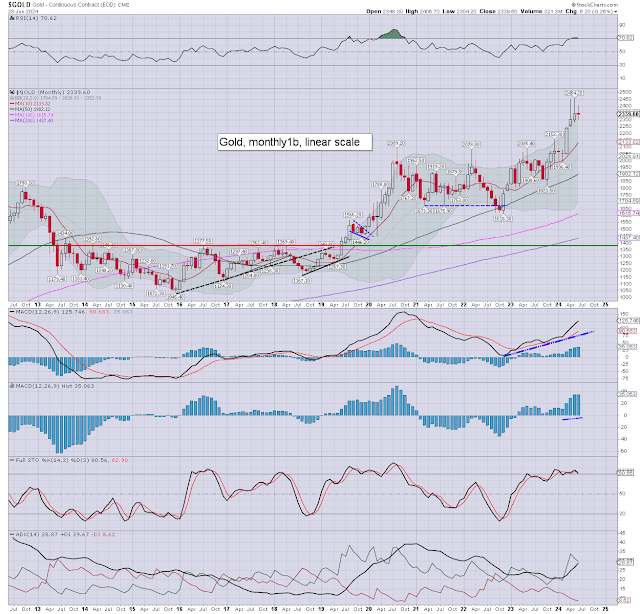

Silver, monthly20

Summary

Gold: printing the $2541s, if recovering to settle in the $2681s.. the largest net monthly decline since Sept'2023. Price momentum ticked back downward, but remains on the very high side. I would note the monthly 10MA at $2437, which was settled above, as the m/t trend is bullish.

Lower bond yields helped, but its arguable that the stronger dollar was a major downward pressure.

The removal of 'election uncertainty' was another downward pressure.

A

hit of giant psy' 3K looks out of range before year

end.

--

Silver: printing $29.75, it recovering to settle at $31.11. The biggest net monthly decline since Dec'2023. Momentum ticked back downward, if remaining on

the moderately high side.

I would note the monthly 10MA at $28.79, which was settled above, as the

m/t trend is bullish.

The problem will be if the equity

market sees any cooling into year end. Further downward pressures would be

if the dollar strengthens, or if bond yields increase.

-

Relative to 2011 - when Gold $1923 and Silver $49s, gold is still

outperforming silver. Even the bold will continue to favour gold, which would

better capture a geo-political 'fear bid'.

-

The gold-silver ratio stands at 86.18, and remains historically

high. I'd accept that on a very long term basis (5+ years) silver could

be expected to outperform gold.

As ever, ratio charts should be

especially treated with caution. Whilst October's ratio leaned a

little in favour to silver, both commodities were lower for

the month. Price action is far more important than any ratio.

-

With Bitcoin recently printing a new historic high of $99772, the gold-Bitcoin ratio has broken a new hist' high, currently 36.14. Its a curious thought to realise that it takes around 36x 1oz gold coins to purchase a digital crypto coin, the latter of which has an intrinsic value of $0.00

-

The USD printed the DXY 108s in November, and was certainly one reason gold was net lower for November.

-

For more of the same...

Details/offers > https://www.tradingsunset.com